Key Takeaways:

- U.S. tax residents must report worldwide income, including income from foreign sources, according to IRS regulations.

- U.S. tax residency is determined by meeting the substantial presence test or holding a green card.

- Non-compliance with U.S. tax laws can result in penalties and immigration status issues; consult a tax professional for guidance.

Understanding U.S. Tax Residency and Worldwide Income Reporting

Navigating the complexities of tax obligations can be daunting for many individuals, particularly those who are considering or have already obtained U.S. tax residency. A common question that arises for new residents is whether they must report their income from all over the world when filing U.S. taxes.

The Short Answer: Yes, You Must

If you become a U.S. resident for tax purposes, the U.S. Internal Revenue Service (IRS) mandates that you report your worldwide income. This includes income from foreign sources, regardless of whether it is earned through employment, investments, or any other means.

What Defines U.S. Tax Residency?

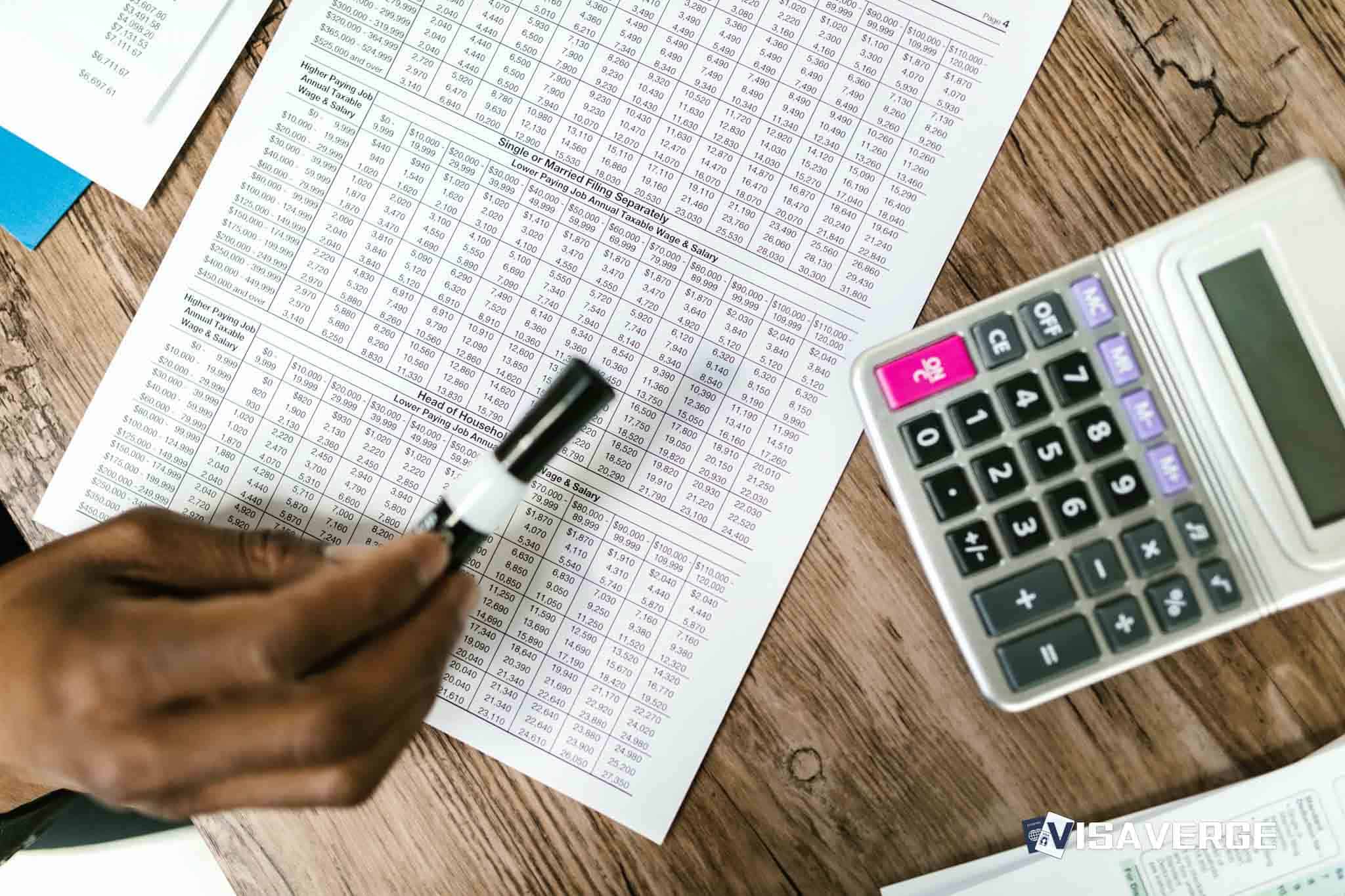

There are certain criteria that determine tax residency in the United States. You are considered a U.S. tax resident if you meet the substantial presence test, which involves being physically present in the U.S. on at least:

- 31 days during the current year, and

- 183 days during the 3-year period that includes the current year and the two years immediately before that, counting all the days you were present in the current year and 1/3 of the days you were present in the first year before the current year, and 1/6 of the days you were present in the second year before the current year.

Additionally, holding a green card also qualifies you as a tax resident from the day you become a lawful permanent resident of the U.S.

Reporting Worldwide Income

Once you qualify as a U.S. tax resident, you must file Form 1040 annually and report income from all sources, both domestic and abroad. This global income may include, but is not limited to:

- Wages or salaries from foreign jobs

- Income from foreign investments or savings accounts

- Profits from foreign businesses

- Rental income from properties outside the U.S.

It’s important to acknowledge that foreign income may also be subject to taxation in the source country, which can lead to double taxation. However, the U.S. offers tax credits and treaties that can mitigate this issue. You may be able to claim a Foreign Tax Credit (Form 1116) for taxes paid to other countries. Additionally, the United States has tax treaties with numerous countries that can reduce or eliminate double taxation.

Deadlines and Penalties

Filing deadlines for U.S. tax residents are similar to those for U.S. citizens. Tax returns are typically due by April 15 of each year. Failing to report foreign income in a timely and accurate manner can result in significant penalties and interest on any resulting tax liabilities.

Importance of Compliance

“Adhering to U.S. tax laws by declaring all sources of income is crucial for maintaining legal and financial standing in the country,” as per IRS guidelines. Non-compliance can have serious ramifications, including fines, penalties, and issues with immigration status for non-citizens.

Conclusion

Becoming a U.S. resident for tax purposes comes with substantial responsibilities, chief among them is the obligation to report worldwide income. Failure to comply with these regulations can lead to serious penalties. It’s always recommended to consult with a tax professional if you are unsure about your tax status or obligations.

For further information and assistance, visit the official IRS website or contact the IRS directly. It’s also advisable to familiarize yourself with the specific tax laws and treaties that may apply to your situation. By staying informed and diligent, you can ensure that you meet all the necessary tax obligations as a U.S. resident.

Still Got Questions? Read Below to Know More:

How do I handle taxes if I own a rental property in Mexico but now live in the U.S. as a tax resident

As a U.S. tax resident owning rental property in Mexico, you’ll need to adhere to tax obligations in both countries. In the United States, the IRS requires you to report income from all sources, both domestic and international. This includes rental income from your Mexican property. You should:

- Report the Income: Include your Mexican rental income on your U.S. tax return. Use the IRS Form 1040, Schedule E (Supplemental Income and Loss) to report this income.

Claim Foreign Tax Credit: Since you may be paying taxes on that rental income in Mexico, you can avoid double taxation by claiming a Foreign Tax Credit on your U.S. tax return. For this, complete IRS Form 1116 (Foreign Tax Credit). This credit allows you to offset the taxes you’ve already paid to the Mexican government against your U.S. tax liability.

Keep Meticulous Records: Maintain detailed records of all income received and expenses paid related to your rental property. These records are essential for accurately reporting your income and for substantiating any deductions or credits you may claim.

In Mexico, you would need to comply with local tax laws concerning your rental property, which includes declaring your rental income and paying any associated taxes. It’s advisable to consult a local tax professional who can guide you through the specifics of the Mexican tax system.

For more information on reporting rental income on your U.S. tax return, visit the IRS’s page on Rental Income and Expenses at irs.gov.

Remember also to review the U.S. Tax Treaty with Mexico, if applicable, which can provide specific rules and benefits concerning your situation. It’s crucial to get professional advice to navigate these waters, since tax laws can be complex and change over time. A U.S. CPA or a tax attorney with experience in international tax issues can provide valuable assistance.

I’m retiring next year and considering moving to the U.S.; will my pension from my home country be taxed by the U.S. if I become a tax resident

When you retire and consider moving to the U.S. as a tax resident, it’s important to understand how your pension from your home country will be treated for U.S. tax purposes. Generally speaking, as a tax resident in the U.S., you are subject to tax on your worldwide income. This includes pensions received from foreign countries.

However, the taxation of your foreign pension can be influenced by whether the U.S. has a tax treaty with your home country. Many tax treaties have specific articles that dictate how pensions are taxed and may allow you to only pay tax on your pension in your home country, or provide for shared taxing rights between the two countries. You would need to carefully review the relevant tax treaty to see how it applies to your situation. The Internal Revenue Service (IRS) provides a list of all U.S. tax treaties that you can refer to for more information: IRS Tax Treaties.

If there is no tax treaty, or if the tax treaty allows the U.S. to tax the pension, then you will generally have to include the pension payments in your U.S. tax return, potentially with a credit for taxes paid in your home country to avoid double taxation. The IRS website offers a Tax Guide for U.S. Citizens and Resident Aliens Abroad, which can provide further information on how foreign income is taxed and how to claim foreign tax credits: IRS Publication 54.

In summary, as a U.S. tax resident, your foreign pension could be taxed by the U.S. depending on the provisions of the applicable tax treaty between the U.S. and your home country, and the IRS’s rules regarding foreign income. It’s advisable to consult with a tax professional who can provide advice tailored to your specific situation.

I studied in the U.S. last year and had a part-time job; do I have to file a tax return for the days I worked even after returning to my country

If you worked in the U.S. while you were a student and earned income, the U.S. tax system generally requires you to file a tax return. This requirement is based on the income you earned while physically present in the U.S., and not necessarily on your residency status at the end of the tax year. Therefore, even if you returned to your home country, you are required to report the income earned during your time in the United States.

Here are the key points to remember when considering your tax filing obligations:

- Income Threshold: If your income from the part-time job was above a certain threshold, you are required to file a tax return. For most single individuals under the age of 65, the threshold for the 2022 tax year is $12,550. Check the latest requirements on the Internal Revenue Service (IRS) website here.

Nonresident Alien Tax Status: As an international student, you might be considered a nonresident alien for tax purposes. If you’re classified as a nonresident alien, you should file Form 1040NR or 1040NR-EZ. You can determine your tax residency status using the Substantial Presence Test, outlined on the IRS website here.

Tax Treaties: The U.S. has income tax treaties with many countries, which may affect how much tax you have to pay. If there’s a tax treaty between the U.S. and your home country, it might contain provisions that reduce or exempt your U.S. income from taxes. Check the IRS list of tax treaties here to see if this applies to you.

In summary, although you’ve returned to your home country, you must still fulfill your tax obligations for the time you spent working in the U.S. It’s recommended to file your tax return by the typical due date of April 15th for the previous tax year, unless an extension is applied. If you’re unsure about how to file, you may want to consult with a tax professional or use resources provided by the IRS for international taxpayers here.

Are there any special tax forms I need to use if I earn money from both U.S. and foreign sources in the same tax year

If you are a U.S. resident or citizen earning income from both U.S. and foreign sources within the same tax year, there are specific tax forms that you may be required to file in addition to the standard Form 1040, U.S. Individual Income Tax Return. Here are the key forms related to foreign income:

- Form 2555 or 2555-EZ – Foreign Earned Income Exclusion:

If you qualify, you can use this form to exclude a certain amount of foreign earnings from U.S. taxation. There are qualifiers for this exclusion, so you’ll need to meet the requirements, such as a physical presence or bona fide residence test. Form 1116 – Foreign Tax Credit:

This form allows you to claim a credit for any taxes paid to a foreign government, which can help avoid double taxation on the same income.FinCEN Form 114 – Report of Foreign Bank and Financial Accounts (FBAR):

If you have foreign financial accounts exceeding certain thresholds, you are required to report these accounts annually.

When filing these forms, you should closely adhere to the rules outlined by the Internal Revenue Service (IRS) to properly report your income and avoid potential penalties. For example, the IRS states:

“If you are a U.S. citizen or resident alien, the rules for filing income, estate, and gift tax returns and for paying estimated tax are generally the same whether you are living in the U.S. or abroad. Your worldwide income is subject to U.S. income tax, regardless of where you reside.”

For authoritative information and forms, you can visit the official IRS website at www.irs.gov. Specifically, for information on foreign income, you can start at the following link: IRS – International Taxpayers.

Remember, it is important to consider the tax treaty between the U.S. and the country from which you are earning income, as these treaties can often impact the tax treatment of your income. It’s advisable to consult with a tax professional who is experienced with international tax law to ensure all reporting is done accurately.

If I just got my green card and I’ve been working overseas all year, do I need to pay U.S. taxes on that income too

Congratulations on receiving your green card. As a U.S. lawful permanent resident, the tax implications change considerably. The U.S. taxes individuals based on their tax residency status. Once you have a green card, you are considered a tax resident and are subject to U.S. tax on your global income. This means you must report all income you earn from both inside and outside of the United States.

According to the Internal Revenue Service (IRS), “If you are a U.S. resident alien, you must report all interest, dividends, wages, or other compensation for services, income from rental property or royalties, and other types of income on your U.S. tax return and pay tax on them.” However, there are provisions to avoid double taxation, such as the Foreign Earned Income Exclusion and the Foreign Tax Credit:

- The Foreign Earned Income Exclusion allows you to exclude a certain amount of your foreign earnings from U.S. tax, subject to specific qualifications and limits. For the current tax year’s exclusion amount, please refer to the IRS website: IRS – Foreign Earned Income Exclusion.

The Foreign Tax Credit provides a dollar-for-dollar credit for the taxes you pay to a foreign government, which can reduce your U.S. tax liability. More guidance on this can be accessed on the IRS website: IRS – Foreign Tax Credit.

It’s essential to be aware of the tax reporting requirements as failure to do so could result in penalties. It is highly recommended you consult with a tax professional who has experience in expatriate taxation to ensure you meet your tax obligations and take advantage of any applicable tax treaties or exclusions. Also, the official IRS website provides comprehensive information and instructions on this topic. Ensure to check for updates regularly as tax laws can change. For additional information and to stay compliant with filing requirements, please visit IRS – Taxation of Resident Aliens.

Learn today

Glossary or Definitions:

- U.S. Tax Residency: The status of being considered a resident for tax purposes in the United States. It is determined by meeting the requirements of the substantial presence test or holding a green card.

Substantial Presence Test: A test used by the IRS to determine if an individual meets the physical presence requirement to be considered a U.S. tax resident. It involves counting the number of days an individual is present in the U.S. over a three-year period.

Green Card: A document issued to immigrants in the U.S. as evidence of their lawful permanent resident status. Holding a green card qualifies an individual as a U.S. tax resident.

Worldwide Income: All income earned by an individual from all sources, both domestic and foreign. For U.S. tax residents, reporting worldwide income is mandatory.

Form 1040: The primary tax form used by individuals filing their annual income tax return with the IRS. U.S. tax residents must file Form 1040 to report their income.

Foreign Tax Credit: A tax credit that allows U.S. taxpayers to offset the taxes paid to foreign countries on their foreign income. It is claimed using Form 1116.

Double Taxation: The situation where an individual is subject to taxation in both the country where the income is earned and the country of their tax residency. Double taxation can occur when an individual has foreign income and must also pay taxes on it in their country of residence.

Tax Treaties: Agreements between two countries that aim to prevent or reduce double taxation. Tax treaties usually specify the rules for taxing different types of income and provide relief from double taxation.

Filing Deadline: The deadline by which taxpayers must submit their tax returns to the IRS. For U.S. tax residents, the typical deadline is April 15 of each year.

Penalties: Financial consequences imposed by the IRS for failing to comply with tax laws. Penalties can vary depending on the nature and severity of the non-compliance.

Compliance: The act of adhering to and fulfilling one’s tax obligations according to the laws and regulations of the IRS. Compliance includes accurately reporting all sources of income and timely filing of tax returns.

IRS: The Internal Revenue Service, the federal agency responsible for administering and enforcing tax laws in the United States. The IRS collects taxes and provides guidance and assistance to taxpayers.

Tax Professional: An individual or firm who specializes in tax law and provides expertise and assistance to taxpayers in navigating their tax obligations. Consulting a tax professional can help ensure compliance and minimize potential issues with taxes.

Tax Obligations: The legal responsibilities and duties individuals and businesses have to pay taxes, file tax returns, and comply with tax laws and regulations. Tax obligations can vary depending on factors such as income, residency status, and type of income.

In summary, as a U.S. tax resident, you must report your worldwide income to the IRS. The rules for tax residency can be complex, so it’s best to consult a professional. Remember to stay compliant with reporting deadlines to avoid penalties. For more information, visit visaverge.com. Stay informed and enjoy hassle-free tax filing!