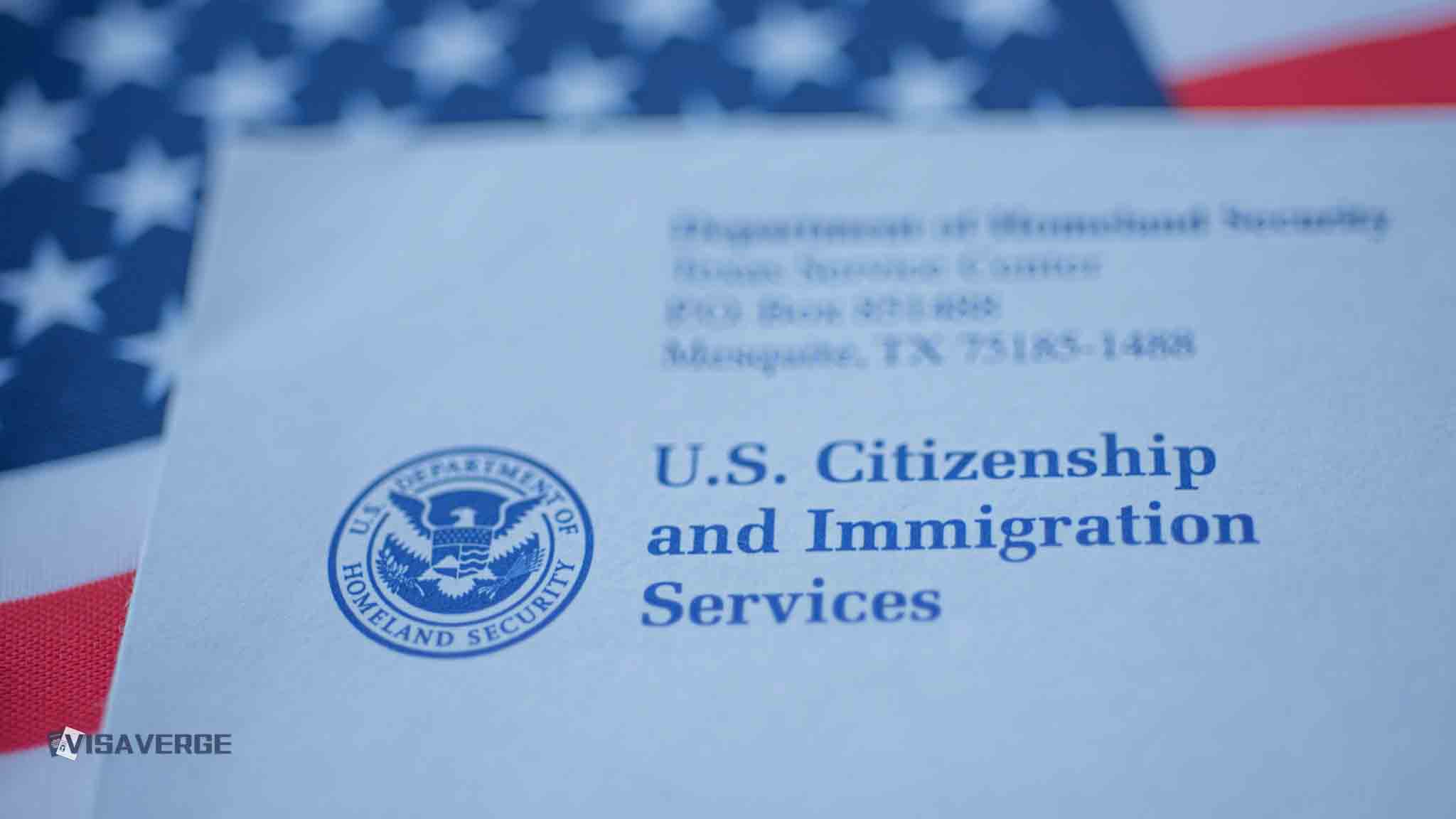

Navigating the Tax Landscape as an L1 Visa Holder

The United States tax system is regarded as complex, and for L1 visa holders, understanding the nuances of how it applies to them can be daunting. If you’re on an L1 visa and wondering how your income will be taxed compared to U.S. citizens, this blog post is tailored for you.

Understanding the Tax Brackets: L1 Visa vs. U.S. Citizens

The first question that comes to mind for many L1 visa holders is whether their taxes are calculated similarly to those of U.S. citizens. In essence, the answer is both yes and no, depending on your resident status for tax purposes.

For an L1 visa holder who passes the Substantial Presence Test and is considered a resident alien for tax purposes, the U.S. tax brackets apply just as they would for U.S. citizens. The IRS provides detailed tables of these tax brackets, which can change annually. Current information on the tax brackets can be found on the official IRS website.

Filing Taxes as a Non-Resident Alien

However, it’s important to highlight that not all L1 visa holders will immediately qualify as resident aliens. If you do not meet the criteria for being considered a resident alien, you will be treated as a non-resident alien for taxation purposes. This means you will be taxed only on income from U.S. sources, and the tax brackets applicable may differ from those of a U.S. citizen or resident alien. More details on non-resident alien taxation can be found on the IRS website dedicated to this category.

Key Points L1 Visa Holders Should Remember

There are a few critical points every L1 visa holder should keep in mind when it comes to U.S. taxes:

- Taxation of Worldwide Income: As a resident alien, similar to a U.S. citizen, you are taxed on your worldwide income.

- Double Taxation Agreements: The U.S. has treaties with many countries that prevent double taxation. It’s vital to determine if your home country has such an agreement with the U.S.

- Deductions and Credits: You may be eligible for certain deductions and credits that can reduce your taxable income, similar to U.S. citizens.

Tax-Filing Status and Considerations

Your tax-filing status is an important factor influencing how your income will be taxed. L1 visa holders may file as a single individual, married filing jointly, married filing separately, or head of household if they meet certain requirements.

It’s also crucial to consider state taxes, as they differ from federal taxes and can have distinct brackets and rates. Depending on which state you reside in, you could be facing additional tax obligations or be eligible for state-specific deductions and credits.

Guidelines for Effective Tax Compliance

To ensure compliance and possibly optimize your tax liability, follow these guidelines:

- Always file your taxes on time to avoid penalties. Typically, tax returns are due by April 15th, unless an extension is filed.

- Keep thorough records of your income and expenses. This is especially important if you need to claim deductions or credits.

- Stay informed about changes in tax laws. Tax laws can change frequently, and you must stay updated to avoid any surprises during tax season.

Conclusion

In conclusion, the tax brackets for L1 visa holders could be the same as for U.S. citizens if they meet the criteria to be considered resident aliens for tax purposes. Non-resident aliens, on the other hand, operate under a different set of tax rules. It is essential for L1 visa holders to understand their tax obligations and to make informed decisions based on their individual circumstances. When in doubt, consulting with a tax professional who is well-versed in the intricacies of L1 visa tax brackets and non-resident alien taxation is a recommended course of action. Remember, staying compliant with your taxes not only avoids legal pitfalls but also establishes your fiscal responsibility as a valued international professional in the United States.

Still Got Questions? Read Below to Know More:

“If I work part-time in the U.S. on an L1 visa, do I still have to file state taxes or just federal

Yes, if you’re working part-time in the U.S. on an L1 visa, you are typically required to file both federal and state tax returns, assuming you’ve earned income in the United States. Federal taxes are paid to the Internal Revenue Service (IRS), while state taxes are paid to the individual state where you earned the income.

For federal taxes:

- You should file a federal income tax return with the IRS.

- Your L1 visa status means you’re considered a resident alien for tax purposes if you meet the “Substantial Presence Test”, which takes into account the days you’ve been physically present in the U.S.

- You can find federal tax information on the IRS website at www.irs.gov.

Concerning state taxes:

- Each state has its own tax system and rules, so the requirements can vary.

- You are usually required to file a state tax return in the state where you earned the income.

- You can find more information about your specific state’s taxation department through the Federation of Tax Administrators website at www.taxadmin.org.

Remember to keep an eye on deadlines for both federal and state tax returns to avoid penalties for late filing. Usually, Tax Day falls on April 15th, but check for any updates or extensions that might apply. It’s always best to consult with a tax professional to ensure you’re meeting all your tax obligations correctly.

“Can I claim my child as a dependent on my taxes if I’m on an L1 visa and they live abroad

If you’re in the United States on an L1 visa, you’re typically considered a resident alien for tax purposes after meeting the substantial presence test, a calculation based on the number of days you’ve been in the U.S. As a resident alien, you’re subject to the same tax rules as a U.S. citizen, which often allows you to claim dependents.

However, to claim your child as a dependent on your U.S. tax return, the child must meet specific criteria as set by the Internal Revenue Service (IRS). According to the IRS, to claim a qualifying child as your dependent, they generally need to:

- Be your child (biological, legally adopted, step, or foster child), sibling, or a descendant of one of these (e.g., your grandchild),

- Have lived with you for more than half of the tax year, and

- Be under age 19 at the end of the year or under age 24 if a full-time student, and younger than you (or your spouse if filing jointly).

Since your child lives abroad, they would likely not meet the residency requirement mentioned in point 2. There are exceptions for children of divorced or separated parents or those who were born or died during the year. However, these exceptions typically don’t apply to children living abroad for the entire year.

For authoritative information on the rules for claiming dependents, you can refer directly to the IRS official website. Here, the IRS offers a tool named “Interactive Tax Assistant” that can help determine if someone can be claimed as a dependent: IRS Interactive Tax Assistant.

It’s always recommended to consult with a tax professional or use IRS provided resources for personalized advice to ensure you’re following the guidelines accurately for your specific situation.

“Are there any tax breaks for L1 visa holders who send money to family back home

As an L1 visa holder in the United States, the tax code can affect you in various ways. While there is no specific tax break solely for sending money to family back home, you may be able to take advantage of general tax deductions and credits available to other taxpayers. Here are some points to consider:

- Charitable Contributions Deduction: If you donate to a U.S.-registered charity, you may qualify for a charitable contributions deduction. However, sending money to individual family members does not qualify as a charitable donation. Always ensure the organization receiving your donation is qualified by referring to the IRS’s database of exempt organizations.

- Personal Exemptions and Dependents: In previous tax years, you could claim personal exemptions for yourself and dependents, potentially including family members back home. However, the Tax Cuts and Jobs Act of 2017 suspended these exemptions for tax years 2018 through 2025. You can review updated information on exemptions and credits through the official IRS website at IRS Tax Reform Basics for Individuals and Families.

-

Foreign Tax Credit: If you have income from foreign sources and pay taxes to a foreign country, you might be eligible for the Foreign Tax Credit. This is not a deduction or credit for sending money to family, but it could lower your U.S. tax liability if you’re paying taxes in more than one country. For specifics on the Foreign Tax Credit, consult the IRS page dedicated to it: IRS Foreign Tax Credit.

Keep in mind that tax laws can be complex and may have changed from the time this information was written. It’s advisable to consult a tax professional familiar with L1 visa holder concerns or check the IRS’s website for the most up-to-date tax information. Remember, your tax obligations depend on various factors, including residency status and individual circumstances.

“How do I handle taxes from my rental property in my home country while I’m in the U.S. on an L1 visa

Handling taxes on a rental property in your home country while you’re in the U.S. on an L1 visa can be a bit complex. The first step is to understand that as an L1 visa holder, you are generally considered a resident alien for tax purposes if you meet the substantial presence test. This means you are taxed on your worldwide income, which includes your rental income from your home country.

Here’s what you should do:

- Report Your Income: You need to report your rental income to the Internal Revenue Service (IRS) on your U.S. tax return using Form 1040, and attach Schedule E (Form 1040) – “Supplemental Income and Loss”.

- Use Foreign Tax Credit: To avoid double taxation, you may claim a foreign tax credit on Form 1116 for taxes paid to your home country on the rental income.

- Understand the Tax Treaty: Some countries have a tax treaty with the U.S., which may offer specific tax benefits or exemptions. Check if such a treaty exists and how it may impact your taxable rental income.

- “The United States has income tax treaties with a number of foreign countries. Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate, or are exempt from U.S. taxes on certain items of income they receive from sources within the United States.” (IRS)

- Keep Accurate Records: Maintain thorough records of all expenses related to your rental property, as you might be able to deduct these from the rental income on your U.S. tax return.

Remember to review the IRS website for information regarding reporting foreign income and claiming credits to avoid double taxation. Here are two relevant links you may find helpful:

Moreover, for the tax laws in your home country, it is best to consult with a tax professional or refer to that country’s tax authority to ensure compliance with local regulations. It’s always prudent to seek advice from a tax advisor who understands both U.S. tax laws and the tax laws of your home country to accurately navigate your obligations.

“What happens if I move states while on an L1 visa – do I file taxes in both states

If you move states while on an L1 visa, your tax situation may involve filing in both states, but it depends on the individual tax laws of the states involved. Typically, you’ll be considered a resident for tax purposes in the state where you have your primary residence. Here’s what you need to do:

- File a Part-Year Resident Tax Return: If you’ve earned income in two different states due to a move, you will likely need to file part-year resident tax returns in each state. This means you’ll file a tax return in your old state for the portion of the year you lived there and another one in your new state for the time you’ve been residing there. Be prepared to allocate your income to the period you lived in each state.

- Understand Reciprocal Agreements: Some states have reciprocal tax agreements, meaning they allow residents of neighboring states to file a tax return in only one of the states. However, if the states you’re moving between do not have such an agreement, filing in both states is necessary.

“When you make a move to another state while on an L1 visa, you are subject to the tax laws of both the state you move from and the state you move to,” according to the IRS. “If both states tax income, you generally must file a state income tax return for each state in which you resided during the year.”

For authoritative information on state taxes, it’s advisable to check each state’s Department of Revenue or Taxation website, such as the California Franchise Tax Board (https://www.ftb.ca.gov/) or the New York Department of Taxation and Finance (https://www.tax.ny.gov/). For federal tax obligations and more information on taxation as it relates to immigration status, the IRS website (https://www.irs.gov/individuals/international-taxpayers) is the go-to resource.

Please remember that state tax laws can be complex, and it’s often beneficial to consult with a tax professional who can provide personalized advice based on your specific circumstances.

Learn today

Glossary or Definitions Section

- Tax Brackets: These are the income ranges used to determine the rate at which income is taxed. The United States has a progressive tax system, meaning that individuals with higher incomes are taxed at higher rates.

- Resident Alien: A person who is not a U.S. citizen but meets the criteria to be considered a resident for tax purposes. Resident aliens are subject to the same tax rules as U.S. citizens and are taxed on their worldwide income.

-

Substantial Presence Test: A test used by the IRS to determine if a foreign national is considered a resident alien for tax purposes. It considers the number of days the individual is present in the United States over a three-year period.

-

Non-Resident Alien: A person who is not a U.S. citizen and does not meet the criteria to be considered a resident alien for tax purposes. Non-resident aliens are taxed only on income from U.S. sources and have different tax brackets compared to U.S. citizens and resident aliens.

-

Taxation of Worldwide Income: This means that as a resident alien, you are subject to U.S. income tax on income earned both within and outside of the United States.

-

Double Taxation Agreements: These are agreements between the United States and other countries that aim to prevent individuals from being taxed on the same income by both countries. These agreements often provide relief by allowing for credits or exemptions to avoid double taxation.

-

Deductions and Credits: These are provisions in the tax code that allow taxpayers to reduce their taxable income or apply credits to reduce their tax liability. L1 visa holders may be eligible for certain deductions and credits, similar to U.S. citizens.

-

Tax-Filing Status: This refers to the category or status under which a taxpayer files their tax return. L1 visa holders may file as a single individual, married filing jointly, married filing separately, or head of household, depending on their individual circumstances.

-

State Taxes: Taxes levied by individual states on income, sales, property, and other sources. State tax rates and rules can vary significantly from federal tax rates and rules.

-

Tax Compliance: The act of fulfilling tax obligations by accurately reporting income, calculating tax liability correctly, and submitting tax returns on time.

-

Tax Professional: An individual, such as a certified public accountant (CPA), enrolled agent (EA), or tax attorney, who has expertise in tax laws and can provide guidance and assistance with tax matters.

-

Extension: An additional period of time granted by the IRS to file a tax return beyond the original due date. It allows individuals to avoid penalties for filing late.

Navigating the U.S. tax landscape as an L1 visa holder can be overwhelming, but understanding the basics is crucial. From tax brackets to filing statuses, there are key considerations to keep in mind. Don’t fret, though! To explore more on this topic, head over to visaverge.com and discover expert insights and tips to make tax season a breeze.