Navigating Health Insurance Requirements for H1B Visa Holders

Navigating the U.S. healthcare system can be challenging, especially for those on work visas. The Affordable Care Act (ACA), commonly known as Obamacare, has specific implications for H1B visa holders – professionals working in the U.S. under a temporary employment visa. Understanding the ACA’s requirements is critical to ensuring compliance and avoiding penalties.

Understanding the Affordable Care Act H1B Connection

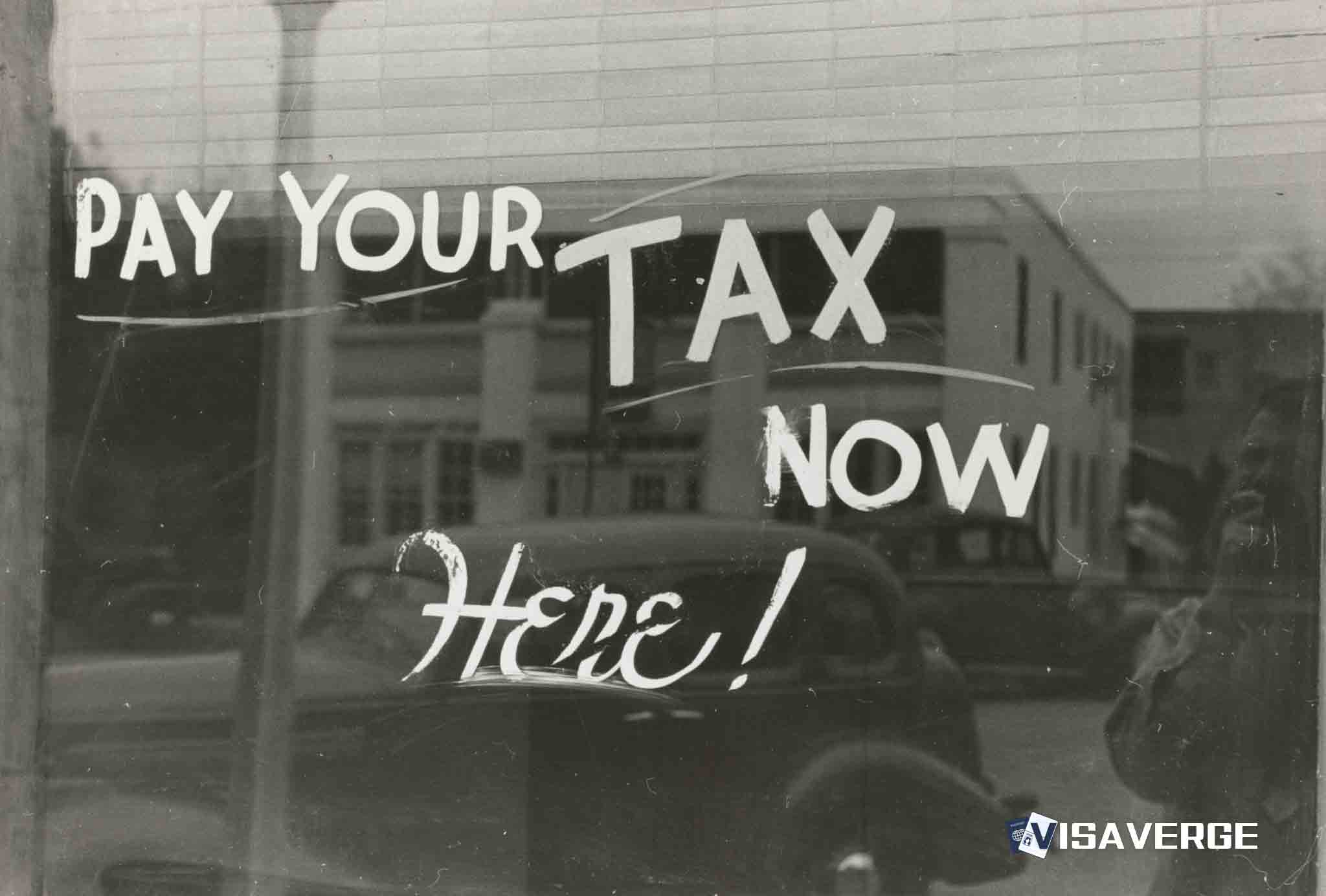

The ACA mandates that all U.S. residents, including H1B visa holders, have health insurance coverage or face a penalty. This law aims to reduce the overall costs of healthcare by spreading risk across a larger number of insured individuals. As an H1B visa holder, it’s essential to be aware that you’re subject to the mandates of the ACA just like U.S. citizens and permanent residents.

The Impact of ACA on Work Visa Immigrants

For those on H1B visas, the ACA presents both challenges and benefits. A significant impact is the requirement to hold insurance coverage, which may raise the question of how to find affordable options that comply with visa conditions. Employers typically offer health insurance as part of the benefits package, but some H1B employees may find themselves in between jobs or working for employers who do not provide such benefits.

H1B Visa Holder Health Insurance Requirements: What You Need to Know

As an H1B visa holder, you need to maintain health insurance coverage for the duration of your stay in the U.S. Failing to do so can result in tax penalties. Here are the essential points to understand:

- Enrollment in Employer-sponsored Plans: Many employers offer health insurance as part of their benefits. Ensure that the offered plan complies with ACA standards.

- Marketplace Options: If your employer does not offer insurance or you prefer a different plan, the Health Insurance Marketplace provides options. Plans here are ACA-compliant and based on your income; you may qualify for subsidies.

- Special Enrollment Periods: Job changes or other life events may qualify you for a Special Enrollment Period, allowing you to sign up for a Marketplace plan outside the annual Open Enrollment Period.

- Tax Penalties: Not maintaining ACA-compliant coverage could result in a penalty at tax time. However, there have been changes, and starting with the tax year 2019, the penalty for not having coverage was reduced to zero at the federal level, but some states still impose their penalties.

It’s essential to be proactive in understanding and meeting these requirements to avoid unexpected costs and ensure your stay in the U.S. remains uninterrupted.

Accessing Affordable Health Insurance Plans

Finding an affordable health insurance plan is a priority for H1B visa holders. Here are some steps to consider:

- Consult with your employer about available health insurance options.

- Explore the Health Insurance Marketplace during Open Enrollment or if you’re eligible for a Special Enrollment Period.

- Consider health insurance brokers or private insurers for additional options that may suit your needs.

Always make sure that any plan you consider meets the minimum essential coverage requirements of the ACA.

Staying Informed and Compliant

Compliance with the ACA is critical for H1B visa holders both in maintaining legal status and avoiding financial penalties. Here are some final tips to ensure you’re on the right track:

- Stay informed about any changes in health insurance mandates and requirements, particularly those that apply to your visa status.

- Consult with an immigration attorney or a tax professional if you have complex situations or need personalized advice.

- Keep records of your health insurance coverage as proof of your compliance with the ACA.

For more detailed information on immigration and visa-related health insurance requirements, visit the U.S. Citizenship and Immigration Services (USCIS) or HealthCare.gov.

As an H1B visa holder, the Affordable Care Act has direct implications on your stay in the United States. By adhering to the mandates while seeking out affordable insurance coverage, you can safeguard your health and remain in good standing with immigration regulations. Remember, staying compliant with the ACA is not only about fulfilling legal duties – it’s about ensuring that you and your family are protected in a country far from home.

Still Got Questions? Read Below to Know More:

“I’m switching from an F1 student visa to an H1B; what steps should I take to ensure continuous health insurance coverage during this transition

To ensure continuous health insurance coverage during your transition from an F1 student visa to an H1B visa, you should take the following steps:

- Assess Your Current Coverage: Review the details of your current health insurance plan often provided by your educational institution. Determine when this coverage will expire. Typically, your student health insurance will end shortly after you graduate or when your F1 status changes.

- Communicate with Your Employer: Talk to the Human Resources department at your future workplace to understand when your H1B-sponsored health insurance will begin. There’s often a waiting period before new employee benefits start, which could leave a gap in your coverage.

“Ask your employer if they offer ‘bridge’ insurance policies or if they can start your insurance coverage earlier to prevent any gaps.”

- Explore Alternative Options: If there’s a gap between your student health insurance ending and your work-based coverage beginning, consider purchasing short-term health insurance or a continuation of coverage through your school’s plan if it’s offered. Another option could be the Consolidated Omnibus Budget Reconciliation Act (COBRA), which can temporarily extend your current coverage. Make sure to compare plans and choose one that fits your needs and budget.

For more information on health insurance and H1B visa, you can check the U.S. Citizenship and Immigration Services website www.uscis.gov or the official healthcare marketplace www.healthcare.gov. Always turn to authoritative immigration and health insurance sources for up-to-date and accurate information.

“As an H1B holder, if I have a gap in my health insurance because I’m between jobs, will that affect my future green card application or status adjustments

Having a gap in health insurance as an H1B visa holder, caused by being between jobs, generally should not directly affect your future green card application or status adjustments. The United States Citizenship and Immigration Services (USCIS) evaluates green card applications based on a variety of criteria, primarily focused on employment history, legal status, and background checks, rather than health insurance coverage.

However, it’s essential to maintain status during any transition between jobs. According to USCIS, “If you are an H-1B worker and lose your job or otherwise cease to be in an H-1B status, you may be considered out of status.” Being out of status could potentially impact future immigration applications. USCIS considers all aspects of your record, including whether you have maintained legal immigration status while in the U.S.

While it is important to maintain your H1B status at all times, any impact on your green card process due to a lapse in health insurance coverage alone is unlikely. However, always ensure you adhere to the requirements of your visa to avoid complications. If you are concerned about your specific circumstances, you should consult with an immigration attorney or check the latest guidelines from USCIS on maintaining status and employment requirements. For more detailed information, you can visit the USCIS official website for H1B visa holders: USCIS H-1B Page.

“Can my dependents on H4 visas also get health insurance through the Marketplace, and are there any special discounts for families

Yes, dependents on H4 visas can get health insurance through the Marketplace. The Health Insurance Marketplace is a service available in every state that helps individuals, families, and small businesses shop for and enroll in affordable medical insurance. As someone holding an H4 visa, you are considered lawfully present in the United States and thus are eligible to purchase health insurance through the Marketplace.

Additionally, based on your income and the size of your family, you may be eligible for savings on Marketplace insurance plans. These savings can come in the form of premium tax credits or cost-sharing reductions. To qualify for these discounts, you must meet certain income requirements which are based on the federal poverty level.

To find out if you are eligible for these savings, you can use the online tool provided by HealthCare.gov:

- Eligibility: “See if you qualify for a health insurance plan with savings.“

It is important to note that you will need to provide information about your income and household size in your application to determine your eligibility for any premium tax credits or cost-sharing reductions. When applying for Marketplace coverage, you will need to indicate that you are a “lawfully present” immigrant which includes holders of H4 visas. For more detailed information, you should visit the official Marketplace website:

- Marketplace Information: “Insurance for lawfully present immigrants.“

Remember to apply during the open enrollment period, or check if you qualify for a special enrollment period if you experience certain life events, such as moving or losing other health coverage.

“If I’m on an H1B visa and just lost my job, how long do I have to find a new health insurance plan before I face any penalties or issues with my visa status

If you are on an H1B visa and have lost your job, the period commonly referred to as the “grace period” gives you 60 days to find new employment and maintain your visa status. However, this grace period does not directly pertain to health insurance coverage—it is meant for maintaining legal status in the United States. The health insurance aspect will depend on your employer’s policy. Generally, employers can terminate your health insurance coverage either on the day of your employment termination or at the end of the month during which you were terminated.

“Under regulations, H1B workers are allowed a grace period of up to 60 days whenever employment ends so the visa holders can pursue new employment and an extension of their H1B status or to make preparations to depart the U.S.” – Source: U.S. Citizenship and Immigration Services (USCIS), available at the official USCIS website: Grace Periods for Nonimmigrant Workers.

To avoid penalties or issues related to health insurance, you should explore options such as:

- Continuation of Health Coverage (COBRA): Under the Consolidated Omnibus Budget Reconciliation Act (COBRA), you may be eligible to continue your employer-sponsored health insurance for a limited period after job loss.

- Marketplace Insurance Plans: You are also entitled to a Special Enrollment Period due to loss of job-based insurance to enroll in a plan through the Health Insurance Marketplace.

For more information about COBRA continuation coverage, you can visit the U.S. Department of Labor’s website: COBRA. To learn about the Health Insurance Marketplace and Special Enrollment, check out HealthCare.gov: HealthCare.gov.

It’s essential to act quickly on your health insurance as there may be time-sensitive requirements for enrolling in COBRA or Marketplace insurance, which could result in fines or penalties if missed. However, not maintaining health insurance is not a direct violation of your H1B status but can lead to financial risk if you have medical emergencies without coverage.

“What are my health insurance options if the company I’m working for as an H1B visa employee offers a plan that’s too expensive for my budget

If the health insurance plan offered by your employer on an H1B visa is too expensive for your budget, you have several options to consider for obtaining more affordable coverage:

- Marketplace Insurance Plans: You can shop for a plan on the Health Insurance Marketplace at HealthCare.gov. Depending on your income and the state you live in, you may qualify for premium tax credits or cost-sharing reductions that make these plans more affordable.

- Spouse’s Employer Plan: If you have a spouse who is also working in the U.S., you might be eligible to join their employer-sponsored health plan, which could be more cost-effective.

- Short-Term Health Insurance: Short-term health insurance provides temporary coverage and can be less expensive. However, it’s important to note that these plans often offer less comprehensive coverage.

- Student Health Plans: If you are studying as well as working, you might look into a student health plan offered by the educational institution.

It’s essential to compare the coverage, premiums, deductibles, and out-of-pocket costs when exploring these alternatives, to ensure they meet your healthcare needs and budget. Keep in mind that as an H1B visa holder, maintaining health insurance is crucial for protecting yourself from high medical costs resulting from unexpected illnesses or accidents.

For more information and to explore plans, visit the official Health Insurance Marketplace at “HealthCare.gov”. Remember that immigration status can affect eligibility for some plans, so be sure to check the specific requirements for H1B visa holders while shopping for insurance.

“If you’re not eligible for any of these plans, you can also look into private individual health insurance plans directly from insurance companies. However, be aware that prices can vary widely based on the level of coverage and other factors.”

Always read plan details carefully and make sure you understand the benefits and limitations of any health insurance policy before purchasing it.

Learn today

Glossary

- Affordable Care Act (ACA): Also known as Obamacare, the ACA is a law in the United States that mandates that all U.S. residents, including H1B visa holders, must have health insurance coverage or face a penalty. Its goal is to reduce healthcare costs by spreading risk across a larger number of insured individuals.

- H1B Visa: The H1B visa is a temporary employment-based visa that allows foreign professionals to work in the United States for a specific period of time. H1B visa holders must comply with the same healthcare insurance requirements as U.S. citizens and permanent residents.

-

Health Insurance Coverage: Health insurance coverage refers to having a health insurance plan that provides financial protection in case of medical expenses. H1B visa holders are required to maintain health insurance coverage throughout their stay in the U.S.

-

Penalties: Penalties are financial repercussions imposed on individuals who fail to comply with the health insurance coverage requirements of the ACA. H1B visa holders who do not maintain ACA-compliant health insurance may face penalties at tax time, although the federal penalty for not having coverage was reduced to zero starting from the tax year 2019.

-

Employer-sponsored Plans: Employer-sponsored plans are health insurance plans offered by employers as part of their benefits package. H1B visa holders should ensure that the offered plan complies with ACA standards.

-

Health Insurance Marketplace: The Health Insurance Marketplace is an online platform operated by the government where individuals can compare and purchase health insurance plans. H1B visa holders can explore the Marketplace for ACA-compliant plans if their employer does not offer insurance or if they prefer a different plan.

-

Special Enrollment Period: A Special Enrollment Period is an opportunity outside of the annual Open Enrollment Period during which individuals can enroll in a health insurance plan on the Marketplace. H1B visa holders may qualify for a Special Enrollment Period due to job changes or other life events.

-

Tax Penalties: Tax penalties are financial penalties imposed on individuals who do not maintain ACA-compliant health insurance coverage. While the federal penalty for not having coverage was reduced to zero starting from the tax year 2019, some states may still impose their penalties.

-

Minimum Essential Coverage: Minimum Essential Coverage refers to the basic level of healthcare insurance coverage that meets the requirements of the ACA. It is important for H1B visa holders to ensure that any health insurance plan they consider meets the minimum essential coverage requirements.

-

Compliance: Compliance refers to the act of adhering to the mandates, regulations, and requirements set forth by the ACA. H1B visa holders must stay informed and comply with the ACA to maintain legal status and avoid financial penalties.

Expert Insights

Did You Know?

- Immigration has been a significant driver of population growth in the United States for centuries. According to the Migration Policy Institute, immigrants and their U.S.-born children accounted for 55% of population growth in the country between 2011 and 2016.

- The United States has a long history of welcoming immigrants. In fact, the Statue of Liberty, a symbol of freedom and opportunity, was a gift from the people of France to commemorate the Franco-American alliance during the American Revolution. It has since become a powerful symbol of immigration and the American dream.

-

Immigrants have made substantial contributions to the U.S. economy. According to a report by the New American Economy, immigrant-owned businesses generated $1.7 trillion in revenue and employed over 8 million people in 2019. These businesses play a crucial role in job creation and economic growth.

-

The U.S. immigration system has had a significant impact on families. The Immigration and Nationality Act of 1965 abolished the national origins quota system and introduced a preference system based on family relationships and employability. As a result, family reunification became an important principle in immigration policy, allowing families to be reunited with their loved ones in the United States.

-

Immigrants have diverse educational backgrounds and skills. Contrary to common stereotypes, immigrants in the United States are highly educated. According to the Migration Policy Institute, in 2018, 33% of immigrants aged 25 and older held a bachelor’s degree or higher, compared to 32% of U.S.-born adults.

-

Immigrants have helped revitalize cities across the United States. Many immigrants settle in older, declining neighborhoods and contribute to their revitalization through entrepreneurship, home renovation, and cultural enrichment. This process, known as immigrant revitalization, has played a crucial role in the transformation of cities like New York, Chicago, and Los Angeles.

-

Immigration is a global phenomenon. According to the United Nations, there are over 272 million international migrants worldwide, representing 3.5% of the global population. This interconnectedness of people across borders highlights the complexities and importance of immigration policies and their impact on global economies.

-

Immigrants are often highly entrepreneurial. According to a study by the Small Business Administration, immigrants are nearly 30% more likely to start a business than native-born individuals in the United States. These businesses create jobs, drive innovation, and contribute to local economic development.

-

Immigration can have positive effects on native-born workers. Multiple studies have shown that immigration has a positive impact on wages and employment for native-born workers. Immigrants often fill labor gaps, allowing businesses to expand and create more job opportunities for all workers.

-

Immigration has shaped American culture and society in numerous ways. From cuisine and music to literature and art, immigrant contributions have enriched the cultural fabric of the United States. The diversity brought by immigrants has created a vibrant and dynamic society that continues to evolve.

Remember, these fascinating facts about immigration provide just a glimpse into the complex and multifaceted nature of this topic. Delve deeper into the world of immigration to discover more remarkable stories and insights.

So there you have it – navigating health insurance requirements for H1B visa holders doesn’t have to be a daunting task. By understanding the Affordable Care Act and exploring your options, you can find affordable coverage that meets the ACA’s standards. Remember to stay informed, consult professionals when needed, and keep records of your coverage. And if you want to dive deeper into the world of visas and immigration, head over to visaverge.com for more helpful information! Happy exploring!