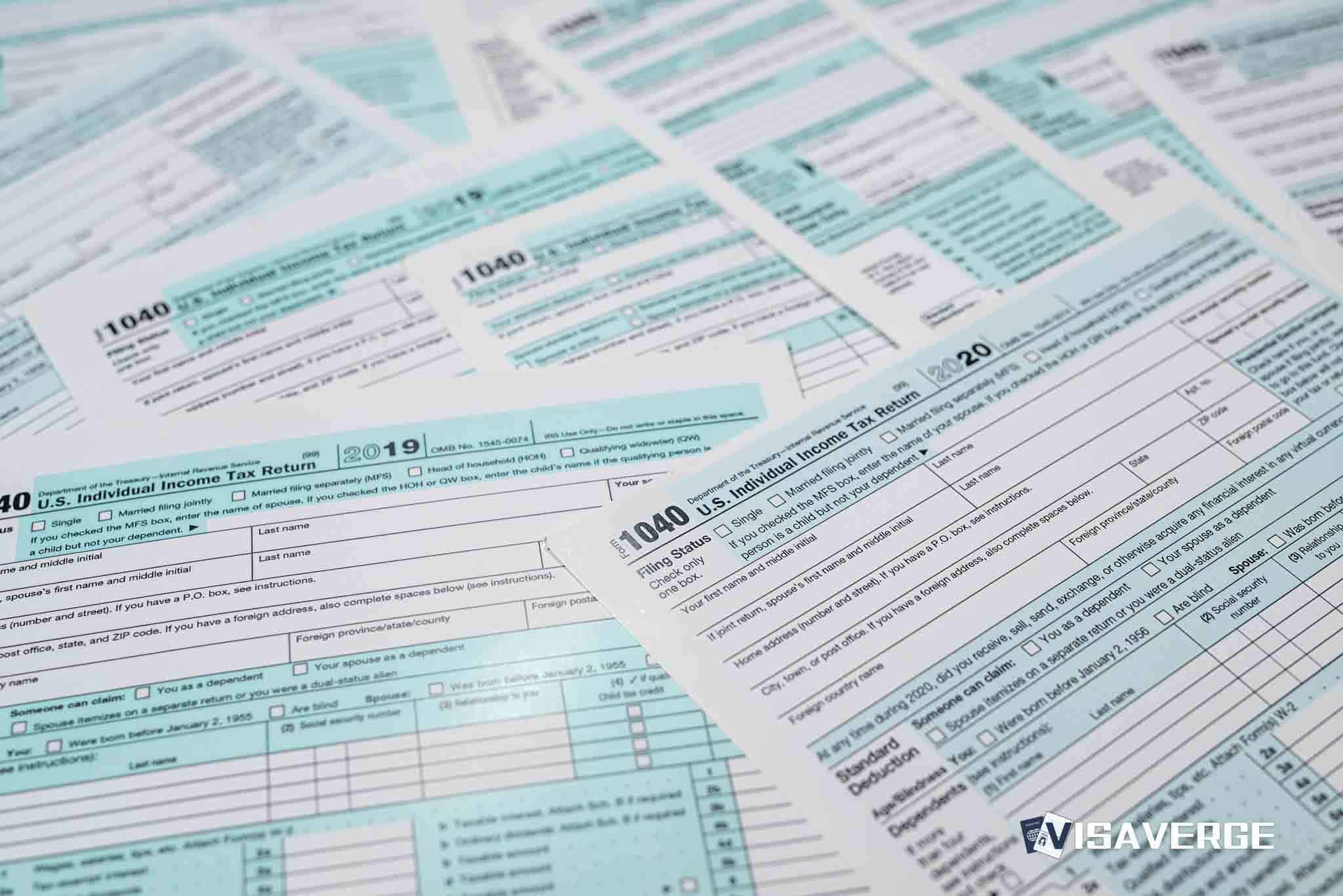

Taxes

Tax Central: Your essential source for the latest in tax laws, filing tips, and deductions. Ideal for navigating complex tax requirements with ease.

SSN vs ITIN for Non-Residents: Who Qualifies and Why It Matters

Choose SSN if authorized to work; choose ITIN if you must file U.S. taxes but aren’t SSN-eligible. SSN processing is 2–4 weeks; ITIN is 6–8 weeks. Notify the IRS to…

Understanding the SSA, SSN, and Employee Benefits in the U.S.

The SSA issues SSNs that link wages to retirement, disability, and survivor benefits and support immigration checks. F-1…

Applying for an SSN as an F-1 Student or H-1B Worker

F-1 students (with CPT/OPT or on-campus jobs) and H-1B employees must apply in person with Form SS-5 and…

Government urged to boost tax coffers with UK Investor Visa proposal

FIFB urged ministers to adopt a new Investor Visa with a £200,000 annual fee and £2.5m ten-year investment,…

Canada exempts graduate students at public DLIs from study permit caps

Starting January 1, 2026, international master’s and PhD students at public DLIs are exempt from Canada’s study permit…

Indian Tax Residency 2025: 182/60-Day Rules and Update Implications

Greater 2025 coordination among India, Canada and the U.S. is increasing automated cross‑border tax notices. Migrants must file…

U.S.–Canada SSA: Totalisation, Detachment Rules, and Benefit Portability

Since August 1, 1984, the U.S.–Canada Totalisation Agreement prevents double pension deductions, uses a 60‑month detachment rule, and…

Overview of the U.S.–Canada Tax Convention for Cross-Border Workers

The U.S.–Canada tax treaty (1980/2007) prevents double taxation for cross-border workers, investors, and retirees by assigning taxing rights,…

Tri-Country Tax Filing for Indians: Canada, U.S., and India

Treaties prevent double taxation for India–U.S.–Canada filers when filings are sequenced and documented. File Canadian departure returns, report…

DTAA Article 23: How Australia and India Avoid Double Tax

The India–Australia DTAA prevents double taxation: Article 15 taxes employment income where earned, and Article 23 gives tax…