Taxes

Tax Central: Your essential source for the latest in tax laws, filing tips, and deductions. Ideal for navigating complex tax requirements with ease.

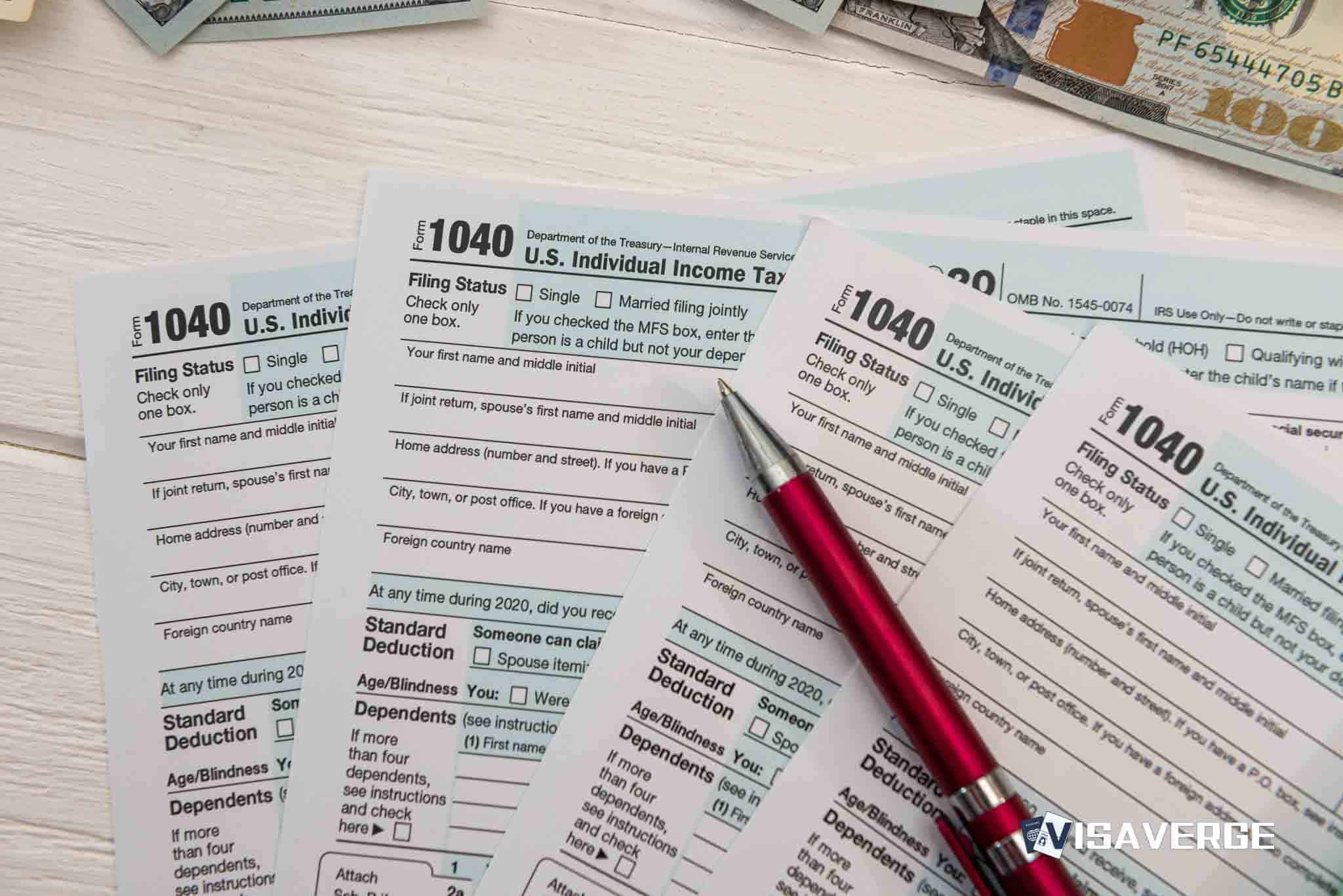

Montana 2026 Tax Brackets: New 4.7% Thresholds and 5.65% Top Rate

Montana's 2026 tax update introduces a 4.7% and 5.65% two-bracket system. Single filers enjoy a 4.7% rate on income up to $95,000. These changes, enacted via House Bill 337, impact…

W-2 vs 1099: Navigating Employment Status for Immigrants

New 2025 regulations link USCIS records with IRS data, making tax compliance a cornerstone of immigration status. H-1B…

Immigrant Families Brace as 1% Remittance Tax Takes Effect

Beginning in 2026, a 1% federal tax will be charged on cash-funded money transfers sent abroad. This excise…

IRA Contribution Limits for 2026: What You Need to Know

IRA limits for 2026 rise to $7,500 (under 50) and $8,600 (50+). Eligibility depends on earned income and…

Delaware 2026 State Income Tax Brackets: Rates and Calculations

Delaware's House Bill 13 introduces new income tax brackets for 2026, lowering some entry-level rates while adding two…

2026 HSA Contribution Limits: Self-Only $4,400, Family $8,750

The IRS announced higher 2026 HSA limits: $4,400 for individuals and $8,750 for families. This guide explains how…

Navigating 2025 U.S. Tax Filing: Immigration Status and Compliance

The 2025 U.S. tax guide for international workers and students explains that tax residency, determined by the Substantial…

IRS Clarifies HSA Rules Under the One Big Beautiful Bill Act

IRS Notice 2026-05 clarifies new HSA eligibility rules under the OBBBA. Key updates include permanent telehealth safe harbors…

2026 Capital Gains Tax Rates and Brackets by Filing Status

The IRS 2026 capital gains tax rates of 0%, 15%, and 20% apply to assets held over one…

New York State 2026 Income Tax Rates and Bracket Updates

New York State will reduce its five lowest income tax rates by 0.1% in 2026, with top rates…