Taxes

Tax Central: Your essential source for the latest in tax laws, filing tips, and deductions. Ideal for navigating complex tax requirements with ease.

Singapore for NRIs: Capital Preservation and Low-Tax Global Wealth

NRIs in the U.S. must report Singapore-sourced income and assets despite Singapore's territorial tax status. U.S. residency triggers worldwide taxation, requiring FBAR and FATCA compliance. The article details residency tests,…

Alaska State Income Tax Rates and Brackets for 2026: No Tax

Alaska will have no state income tax in 2026, eliminating state-level brackets and withholdings. However, federal taxes still…

No Blanket Wire Ban on Public Assistance, Officials Clarify

The U.S. Treasury has implemented new anti-fraud reporting measures in Minnesota, specifically targeting Hennepin and Ramsey counties. International…

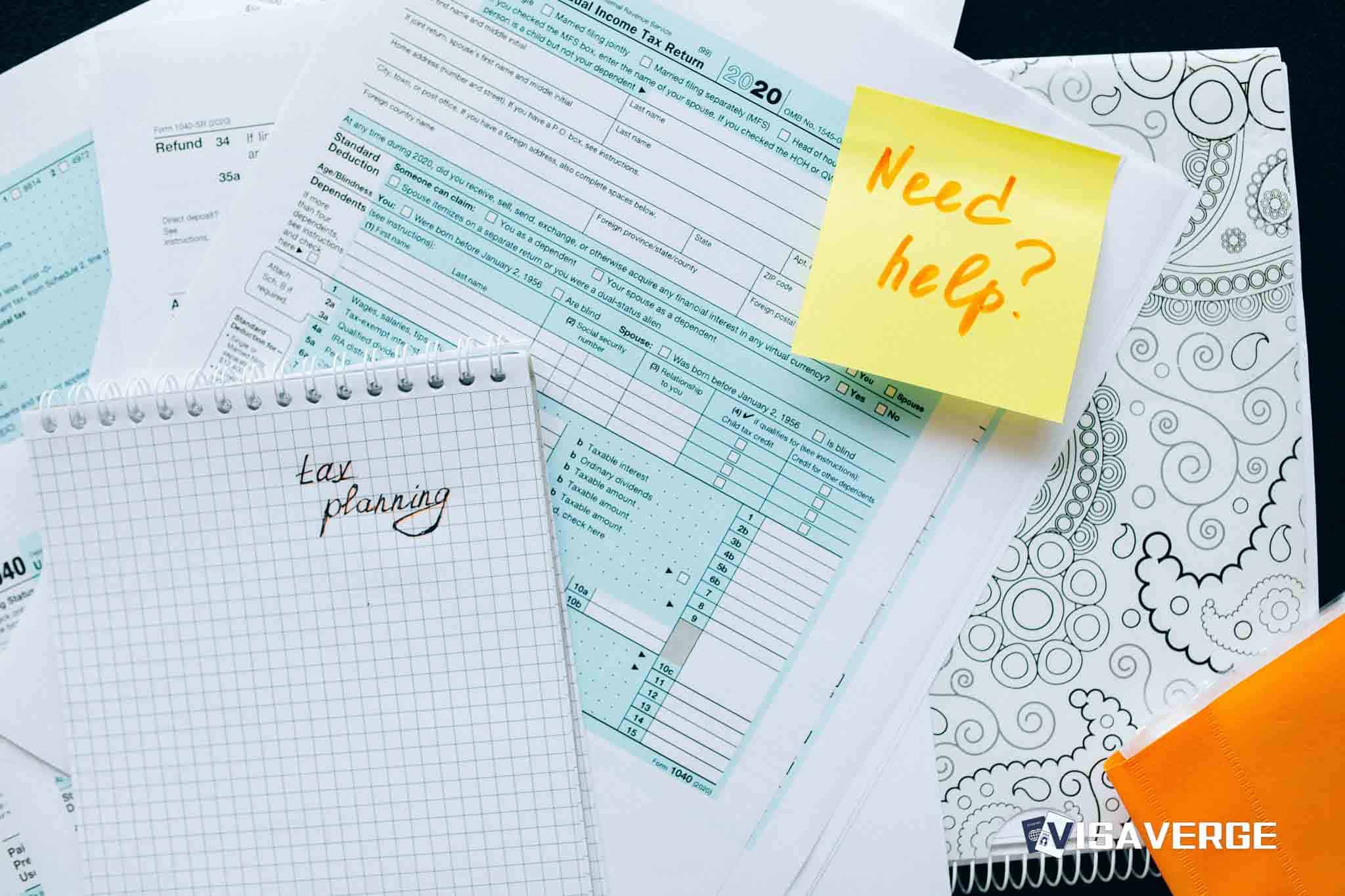

Sell or Hold Foreign Mutual Funds: A Practical Guide for Immigrants

Foreign mutual funds are classified as PFICs by the IRS, requiring complex annual reporting via Form 8621 for…

India Tax Ruling on Mauritius Investments Shakes Global Investor Confidence

India's Supreme Court has ruled that Tax Residency Certificates are no longer sufficient for treaty benefits if an…

Direct Foreign Stocks: Safer, Simpler U.S. Tax Path for Immigrants

The 2026 U.S. tax guide for immigrants clarifies the reporting differences between direct stocks and pooled investments. It…

PFIC Tax Traps for Immigrants and NRIs: Real Examples and Alternatives

Owning non-U.S. mutual funds as a U.S. tax resident creates significant reporting burdens under the PFIC regime. Shareholders…

NRIs in the UAE: Tax-Free Income, Real Estate Growth, and Residency

The UAE offers significant local tax advantages, including no personal income or capital gains tax. However, for U.S.…

2026 401(k) Contribution Limits: How Much You Can Defer

IRS 2026 retirement limits are increasing, with 401(k) deferrals reaching $24,500 and total additions hitting $72,000. For immigrants,…

North Carolina 2026 Tax Rates: 3.99% Flat Income Tax Explained

North Carolina will adopt a 3.99% flat income tax rate in 2026. For new residents and immigrants, understanding…