RNOR vs ROR in India: Navigating DTAA in Mid-Year Migration

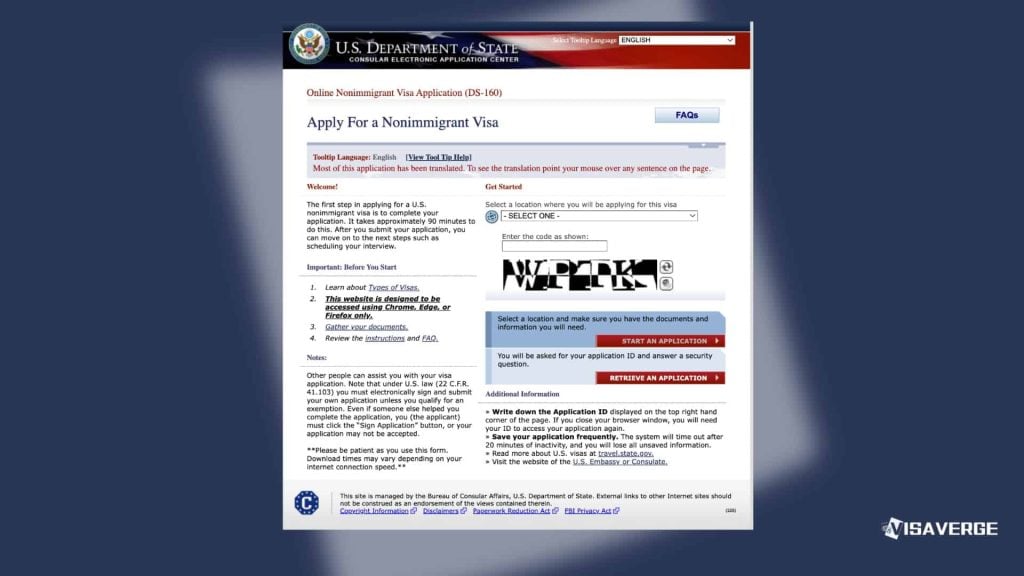

U.S. tax residents moving from India must file 2026 returns by April 15, 2027. Key requirements include reporting worldwide income and filing FBAR for foreign accounts. Although tax treaties prevent…