Questions

Your hub for all the Questions on visas, immigration, and passports. Get answers, solve queries, and engage with immigration experts here.

IRS Offers New Ways to Track Tax Refund for ITIN Holders

The IRS 2026 tax season emphasizes electronic filing and direct deposit as paper checks are phased out. New legislation has increased average refunds through tip and overtime deductions. ITIN filers…

Trump Gold Card Vs. EB-5 Immigrant Investor Program for Indian Investors

The article contrasts the Trump Gold Card's $1 million non-refundable gift with the EB-5 program's $800,000 job-creating investment.…

1040 vs 1040nr: International Students Warned About IRS Penalties for Tax Filing Mistakes

The 2026 tax filing guide for international students outlines how to avoid common pitfalls like using Form 1040…

Federal Controlled Substances Act Leaves F-1 Students Vulnerable Over Marijuana

F-1 students face serious immigration risks from marijuana because federal law classifies it as illegal. Possession, use, or…

US Guidance Revises Change of Status (cos) and H-1B 60-Day Grace Period

The FY 2027 H-1B cap season introduces wage-weighted selection rules effective February 27, 2026. This update covers essential…

U.S. Adjudicative Hold Pending Benefit Applications High-Risk Countries

A 2026 USCIS policy pauses final immigration decisions for 39 high-risk nations, citing security concerns. This adjudicative hold…

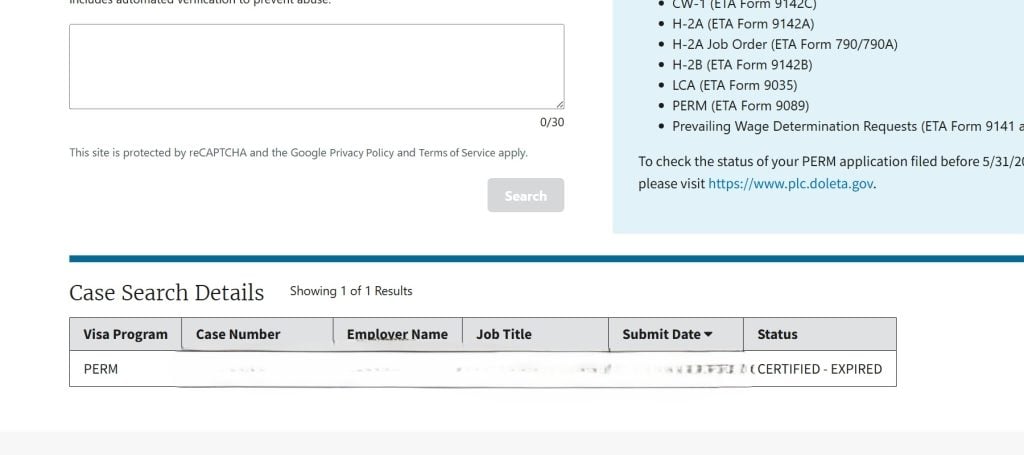

PERM Status Shows “Certified – Expired” After I-140 Approval: What It Means

The 'Certified - Expired' label on a PERM application merely signifies the end of its 180-day validity period.…

Guide Explains U.S. Citizen, Real Estate, India Purchase Rules

U.S. citizens buying property in India, Australia, or the UK must comply with local ownership laws and U.S.…

Gifting to Parents in India: Essential Precautions for US Residents 2026

New 2026 federal rules require U.S. residents gifting money to India to be meticulous with documentation and reporting.…

Prepare for 2026 Tax Season: Key Updates and Tips

A comprehensive guide for immigrants filing 2026 U.S. taxes. It covers residency tests (1040 vs. 1040-NR), the push…