Knowledge

Boost your visa and immigration Knowledge with our comprehensive guides, FAQs, and expert insights to navigate complex legal landscapes with ease.

Know Your Rights Leaflets for Students Amid ICE Threats in 2025

Amid rising ICE activity and the January 2025 revocation of “sensitive locations” guidance, U.S. schools hand out “Know your rights” leaflets explaining silence, refusal of searches without judicial warrants, and…

Refugee and Asylum-Seeker Overview: Global Trends to Sep 2025

As of April 2025, over 122 million people were forcibly displaced worldwide. Major hosts like Türkiye and Iran…

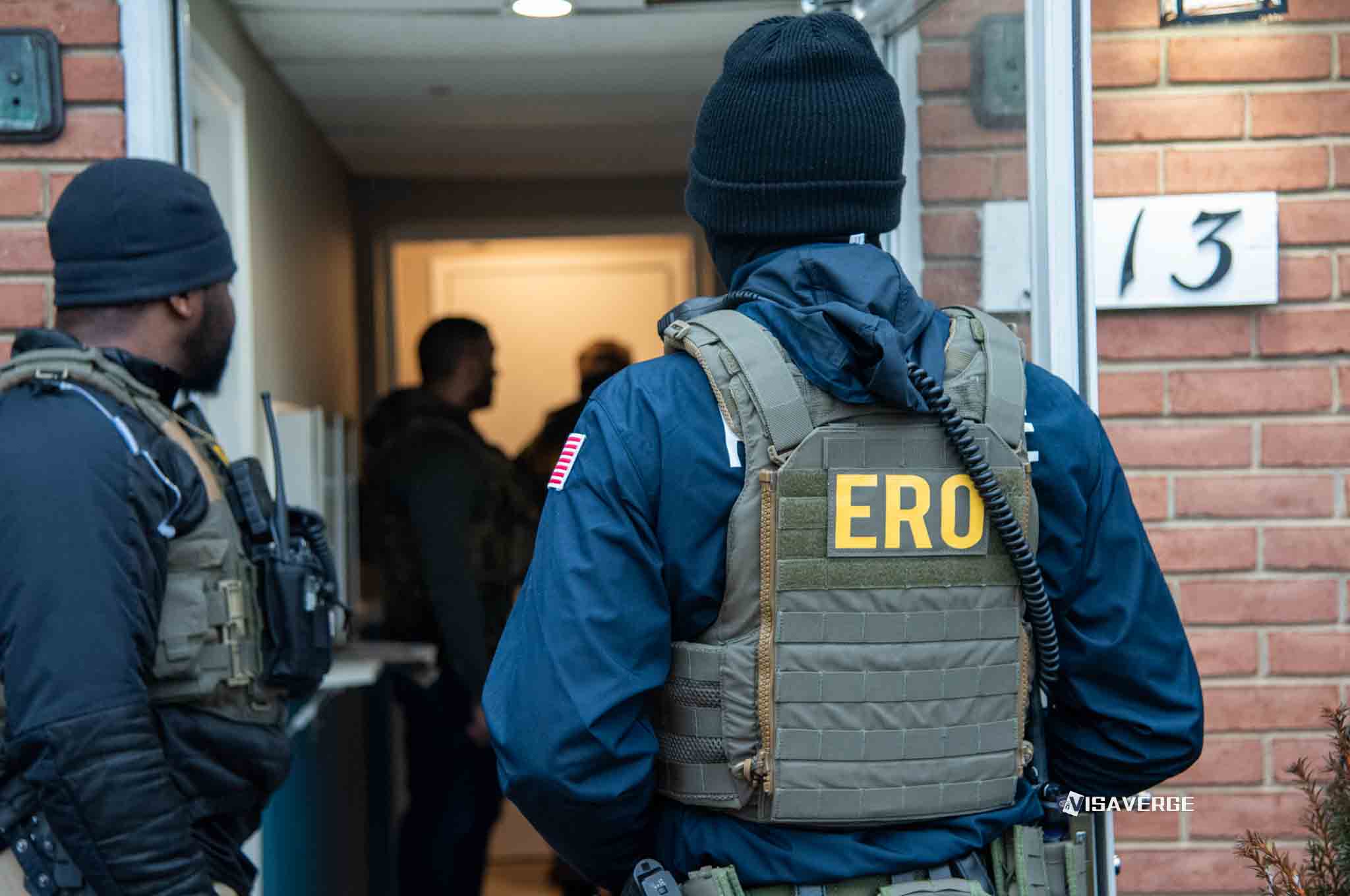

Know Your Rights: Community Preparedness for ICE Encounters

Legal aid groups and advocates run “Know Your Rights” sessions teaching immigrants to recognize warrants, refuse entry without…

Could Your Asylum Case Be Dismissed Over the $100 Annual Fee?

Starting in 2025, asylum applicants must pay a $100 filing fee and $100 annually while cases remain pending.…

Trump H-1B Fee Hike Reshapes Global Tech Talent Flows

A September 2025 executive order imposes a $100,000 H-1B fee and higher salary floors for new petitions, driving…

FBAR Filing Essentials: Form 114 Due April 15 with 6-Month Extension

U.S. persons with foreign accounts over $10,000 must file FBAR (FinCEN Form 114). For 2025 (2024 accounts) the…

FATCA Essentials: Form 8938 thresholds and foreign asset reporting

IRS deadlines require FFIs to certify FATCA compliance by July 1, 2025 for the 2024 period. Taxpayers must…

Nonresident Filing Status for 1040-NR: Single, MFS, QSS

Nonresident aliens filing Form 1040-NR cannot file jointly or as head of household; they must use Single, MFS,…

TCJA Exemptions Repealed: Personal Exemptions Non-Deductible by 2025

The TCJA removed personal exemptions in 2018 and raised the standard deduction; 2025 legislation aims to make that…

Understanding FBAR Definitions: Financial Accounts, Interests, and Rules

U.S. persons must report foreign financial accounts on FinCEN Form 114 if they have financial interest or signature…