Knowledge

Boost your visa and immigration Knowledge with our comprehensive guides, FAQs, and expert insights to navigate complex legal landscapes with ease.

GCC approves One-Stop Travel System, reshaping regional mobility

The GCC will pilot a one-stop travel system between the UAE and Bahrain in December 2025 for GCC citizens, enabling single-point clearance at departure via a shared electronic platform and…

DHS Sets Three Vetting Checks for H-1B and Green Card Applicants

DHS announced a three-prong test—eligibility, economic contribution, integrity—for H-1B and employment-based green cards. A $100,000 fee applies to…

MPI Reforms to Break Dysfunction in U.S. Immigration Courts

MPI finds immigration courts strained by a backlog over 3 million and roughly 700 judges. It recommends reallocating…

Trump’s H-1B Remarks Lift IT Stocks; What It Means for Talent

A presidential remark praising foreign skilled workers lifted sentiment, pushing Indian IT shares up to 3%, though no…

OPT Restrictions Move Forward: H.R. 2315 Aims to End OPT

DHS is drafting rules that may curtail or end F-1 OPT and STEM-OPT, with a proposal expected by…

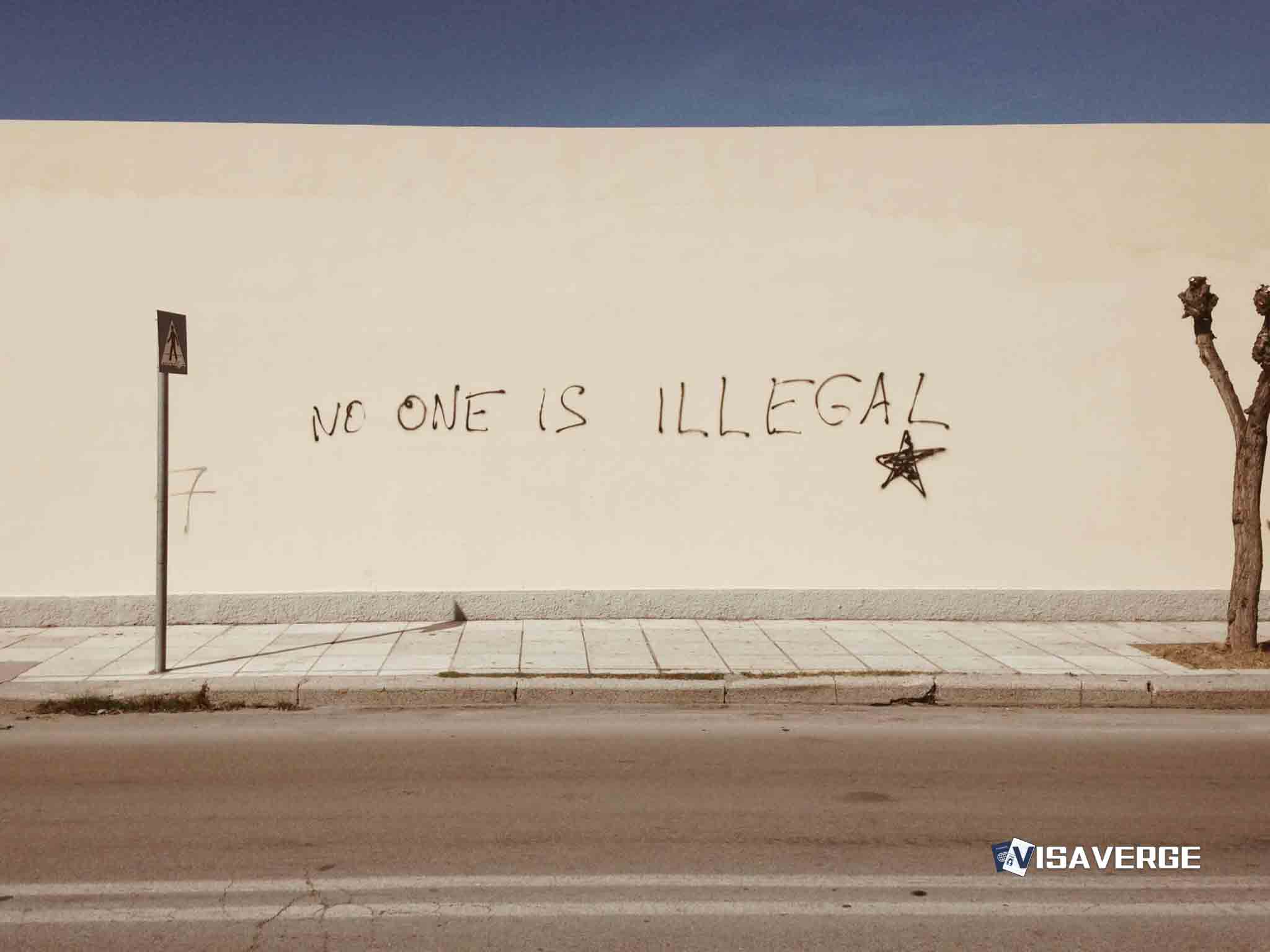

Future of OPT: International Students and U.S. Universities Must Do

OPT and its STEM-OPT extension face possible elimination or restriction via H.R. 2315 and DHS rulemaking. Ending FICA…

Post-Shutdown E-Verify: Three-Day Rule Restored With Grace Period

E-Verify has resumed nationwide; employers must file cases for hires made during the outage by October 14, 2025,…

BIA Finds Immigration Judge Improperly Terminating Pending Case

The BIA’s 2025 decision limits Immigration Judges’ power to terminate removal proceedings to clearly defined regulatory grounds. Humanitarian-only…

International Student Markets and the Threat to Academic Freedom

Heavy reliance on international tuition and stricter visa scrutiny are constraining academic freedom. Financial incentives push universities toward…

U.S. Tax Residency: Resident vs Nonresident Aliens Explained

IRS residency rules use the Green Card Test and Substantial Presence Test to classify taxpayers. Exemptions exist for…