Knowledge

Boost your visa and immigration Knowledge with our comprehensive guides, FAQs, and expert insights to navigate complex legal landscapes with ease.

Chicago Immigration Detention Ruling: Bond Hearings Replace Mass Release

The 7th Circuit Court of Appeals has heightened immigration enforcement risks in Chicago by requiring individualized bond hearings rather than mass releases. Lawful visa holders and H-1B workers must maintain…

2025 Immigration Timeline: What Happened?

This timeline chronicles the rapid and transformative events of 2025 a year defined by the synchronized “hardening” of…

India’s Rise as the World’s Premier Outsourcing Destination

A fundamental shift is underway in how American companies access global talent. The Trump administration’s dramatic immigration restrictions…

Top H-1B Salaries by Occupation and Company

The H-1B visa program has become increasingly stratified by compensation. While the program-wide median hovers around $118,000, top-tier…

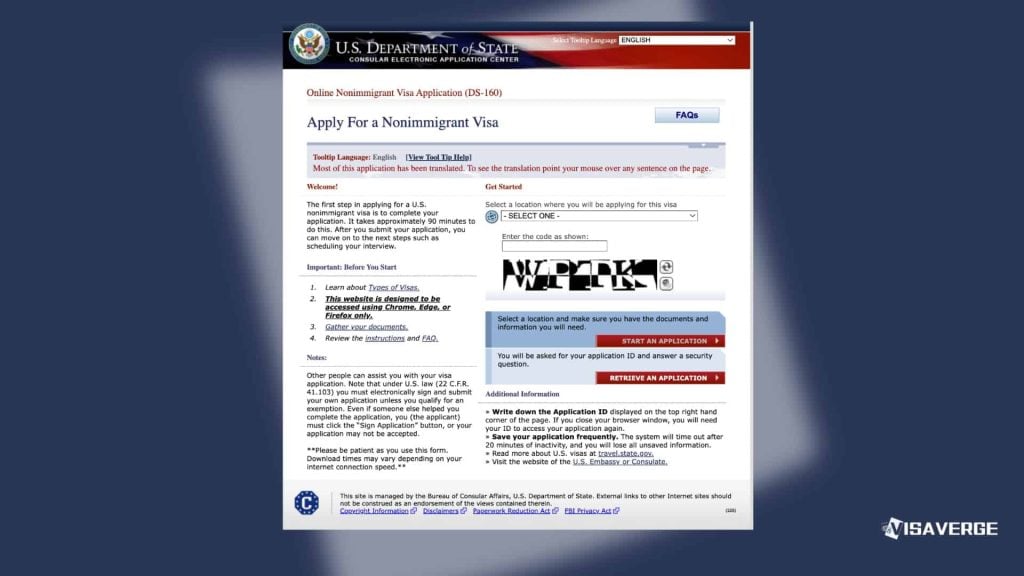

How to List Social Media for DS-160: Step-by-Step Instructions

Applying for a U.S. visa requires disclosing five years of social media history on the DS-160 form. Applicants…

Health Savings Account (HSA) Guide: Contribution Limits and Rules for 2025–2026

The Health Savings Account is one of the most tax-advantaged savings vehicles available in the United States—and it’s…

Long-Term Tax Inefficiencies Caused by U.S. Immigration Backlogs

Immigration backlogs are turning temporary stays into long-term tax liabilities. Because the IRS uses physical presence to determine…

FBAR Penalties Matter Even Without Tax Due: What You Need to Know

FBAR is a reporting requirement for U.S. residents with foreign bank accounts exceeding $10,000. It is separate from…

How State Taxes Undermine Federal Treaty Benefits for Immigrants

Federal tax treaties can reduce federal taxes to zero, but many U.S. states do not recognize these benefits.…

First-Generation Indian Immigrants: Navigating Dual U.S. Tax Rules

Moving to the U.S. involves managing two tax systems. Indian immigrants must report global income and foreign assets…