India

Stay informed about India’s immigration policies, visa requirements, and legal aspects of moving to or from India. This section provides up-to-date information essential for navigating the complexities of Indian immigration law and procedures.

Tatkaal Passport in India: A Comprehensive Step-by-Step Guide

Tatkaal fast-tracks passport applications for genuine urgent travel, typically completing in 1–3 working days after verification. Prepare exact ID/address/DOB proofs, strong dated urgency evidence, pay INR 4,000 plus INR 500…

Indians Face Heightened Scrutiny as Twin Shield Signals Visa Reform

Operation Twin Shield (Sept 19–28, 2025) targeted visa fraud in the Twin Cities: 1,000+ cases reviewed, 900+ site…

U.S. Firms Move High-Value Work to India After $100K H-1B Fee

A $100,000 one-time fee on new H-1B petitions filed after September 21, 2025 is accelerating corporate shifts to…

Can the U.S. Fix the Green Card Backlog for India and China?

A 7% per-country cap and a roughly 140,000 annual limit (including dependents) have created decades-long waits for Indian…

India Leads H-1B Approvals in FY 2024, Capturing 71% Share

In FY 2024 India dominated H-1B approvals with 283,397 (≈71%) of 399,395 total; China had 46,680 (≈11.7%). Rising…

From 214(b) Rejection to Approval: Concise Answers Secure U.S. Visa

A Delhi senior manager overcame a Section 214(b) B1/B2 refusal by giving brief, DS-160‑consistent answers, stressing business purpose,…

Funding EB-5 from India under RBI LRS: pooling, gifts, and steps

Families use RBI’s LRS (USD 250,000 per year) plus co-ownership, cross-year timing, or gifts to assemble EB-5 capital.…

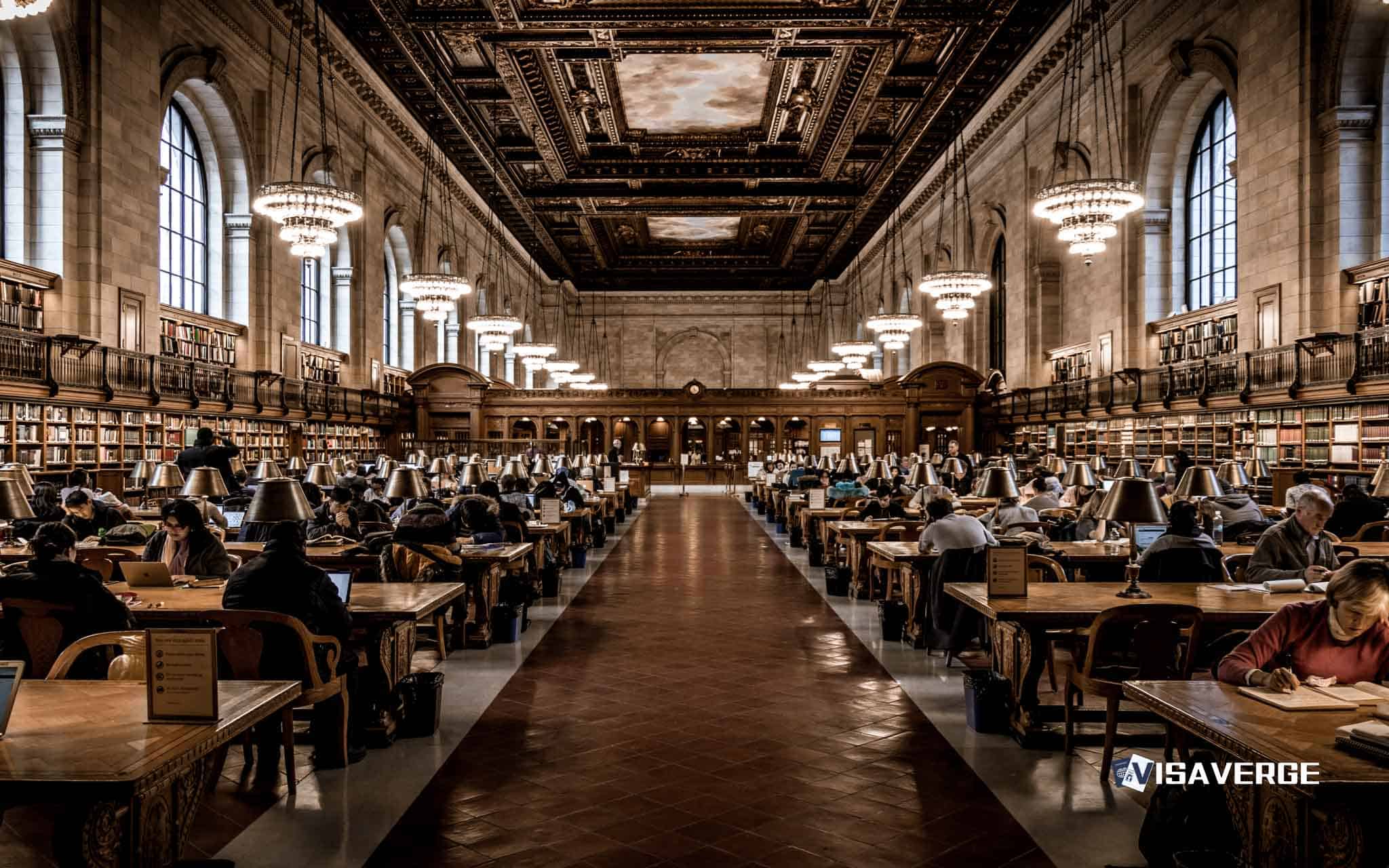

US Faces 2026 Enrollment Decline as Canada, UK Attract Students

Visa backlogs, higher costs, and stronger foreign options risk 150,000 fewer international students in fall 2025 and a…

UAE Remains India’s Top Destination for 2024 Outbound Travel

In 2024 India recorded 30.8 million outbound trips, rising 10.7% year-on-year; the UAE led with about 7.8 million…

US Pushes Market Reforms on India and Brazil Amid Tariff Pressure

The U.S. imposed heavy 2025 tariffs—50% on many Indian and Brazilian exports—and tightened de minimis rules to pressure…