India

Stay informed about India’s immigration policies, visa requirements, and legal aspects of moving to or from India. This section provides up-to-date information essential for navigating the complexities of Indian immigration law and procedures.

Probe Finds Air India Ai171 Crash Likely Result of Deliberate Pilot Action

The investigation into the June 2025 Air India Flight AI171 crash has shifted toward cockpit actions after ruling out mechanical failure. Preliminary data indicates both engines were shut down manually…

Indonesia Launches Global Citizenship Visa to Reconnect Diaspora

Indonesia's new GCI visa allows former citizens and their descendants to obtain long-term residency. It requires a minimum…

UAE Drops Islamabad International Airport Plan After India Visit Denied by Privatisation Commission

Pakistan's Privatisation Commission has dismissed reports of a collapsed UAE airport deal as 'factually incorrect.' While media suggested…

Indiana Senate Advances Senate Bill 76 (SB 76) Authored by Liz Brown (R-Fort Wayne)

Indiana's Senate Bill 76 expands state-level immigration enforcement by mandating local cooperation with ICE detainers and penalizing non-compliance.…

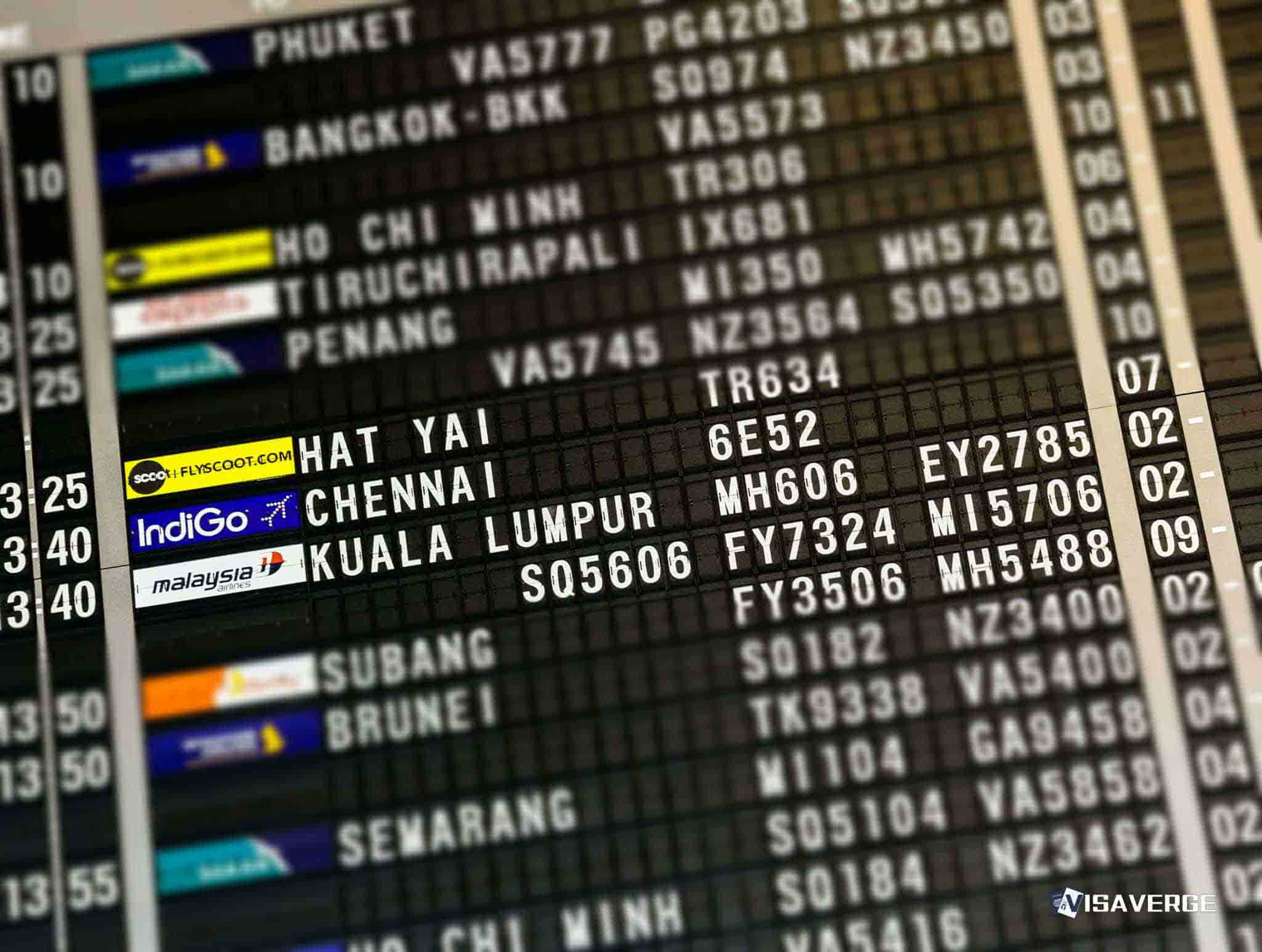

Indigo Extends Cancellations to Baku (azerbaijan) and Tbilisi (georgia) Until Feb 11

IndiGo's nonstop services to the Caucasus and Central Asia remain suspended through February 11, 2026, due to Iranian…

EU Opens Legal Gateway Office New Delhi to Fast‑track Hiring

The EU's new Legal Gateway Office in New Delhi serves as a one-stop information hub for Indians seeking…

India and EU Sign Mobility Pact Memorandum of Understanding in New Delhi

A new India-EU Mobility Pact simplifies visa processes for Indian professionals and students. While it isn't an automatic…

India and European Union Seal Free Trade Agreement in New Delhi to Transform Trade

India and the EU have finalized a historic Free Trade Agreement after 20 years of talks. The deal,…

Overqualified H‑1B Faang Returnee Struggles to Land Jobs Back in India

Indian tech returnees with U.S. experience are struggling to find work at home due to being labeled 'overqualified'…

Infosys Tightens Hybrid Work Policy with Mandatory Office Presence and Quarterly WFH Cap

Infosys now requires global employees to work from the office 10 days per month, with remote flexibility capped…