Guides

Guides simplified: Access expert guidance on visa and immigration paperwork. Get checklists, form overviews, and tips to ensure your documents are in order.

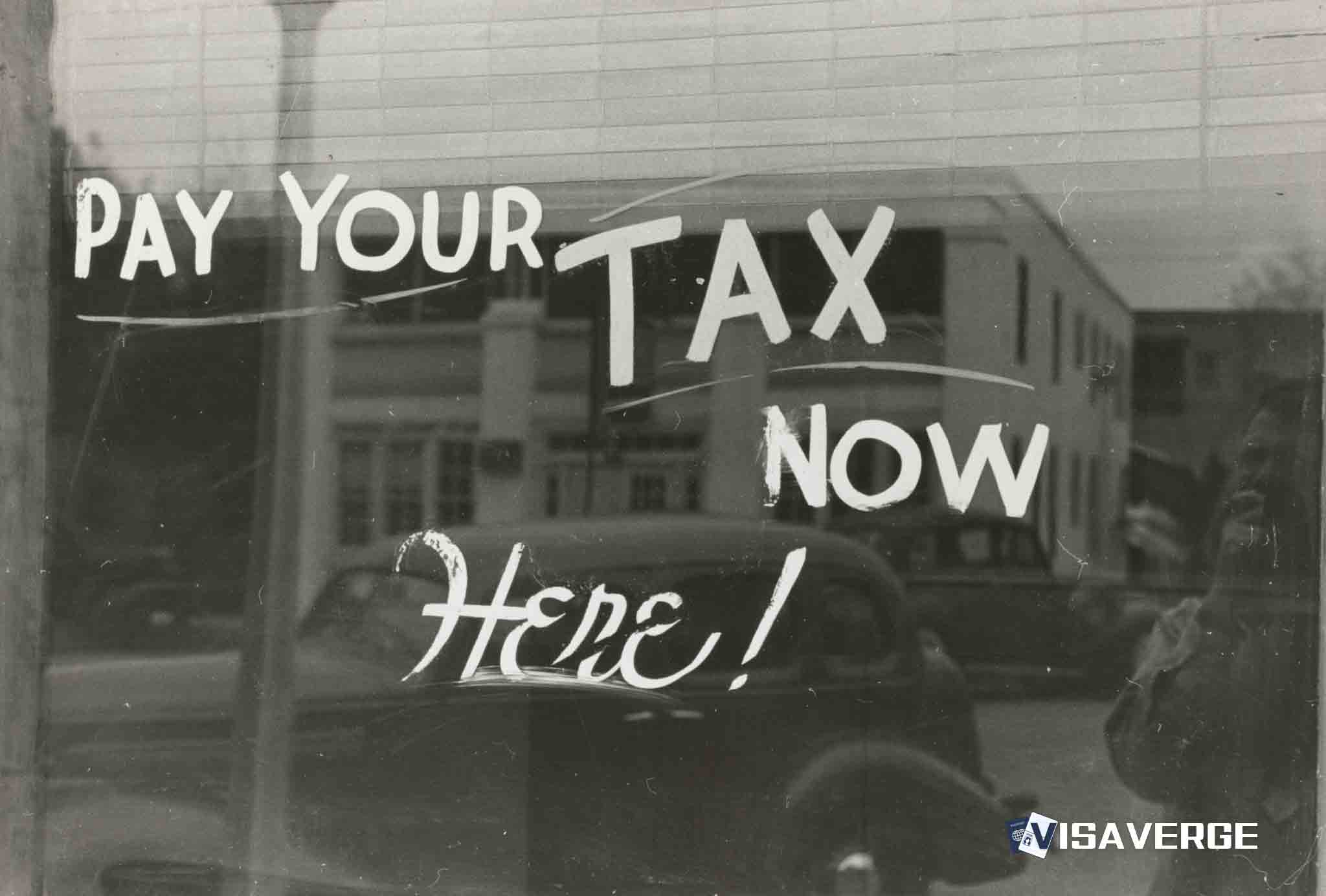

Salary / Employment Income TDS and Filing Deadlines for Income from Salary

Understanding the difference between payroll withholding and final tax liability is crucial for workers in India and the U.S. This article explains how employers estimate taxes, the importance of residency…

Guidance Clarifies Inventory Rules Under U.S. Tax Law for Visa Holders

A comprehensive overview for visa holders on managing business inventory for U.S. tax purposes. It distinguishes between immigration…

Digital Nomad Visas in 2026: Which Countries Are Becoming More U

The 2026 remote work environment provides U.S. citizens with diverse visa options abroad, provided they meet income and…

Understanding Weekly Year and Fiscal Year for U

This 2026 tax guide details the differences between calendar and fiscal years for individuals and businesses. It highlights…

Wyoming REAL ID for Visa Holders 2026: WYDOT Requirements and Timeline

Wyoming's WYDOT will continue issuing REAL ID-compliant cards to visa holders, but a new status mark for non-U.S.…

Michigan REAL ID for Visa Holders 2026: SOS Rules and Documents

Michigan residents on visas now need REAL ID for airport checkpoints. To apply, you must bring original immigration…

Tax Filing Season 2026 Requires Forms for International Students, Nris

The 2026 U.S. tax season requires international students and NRIs to file specific forms like 8843 and 1040-NR.…

After-Tax vs Pre-Tax Return Comparisons: Why the Money You Keep Matter…

Most taxpayers must file 2026 returns by April 15, 2027. For globally mobile individuals, focusing on after-tax returns…

Wisconsin REAL ID for Visa Holders 2026: DMV Requirements, Documents and Steps

Wisconsin Visa holders must now use REAL ID-compliant cards for domestic flights and federal access. Obtaining one requires…

ITIN Application Guide 2026: Step-by-Step with Form W-7

The 2026 ITIN guide details how to apply using Form W‑7 and a tax return. It highlights the…