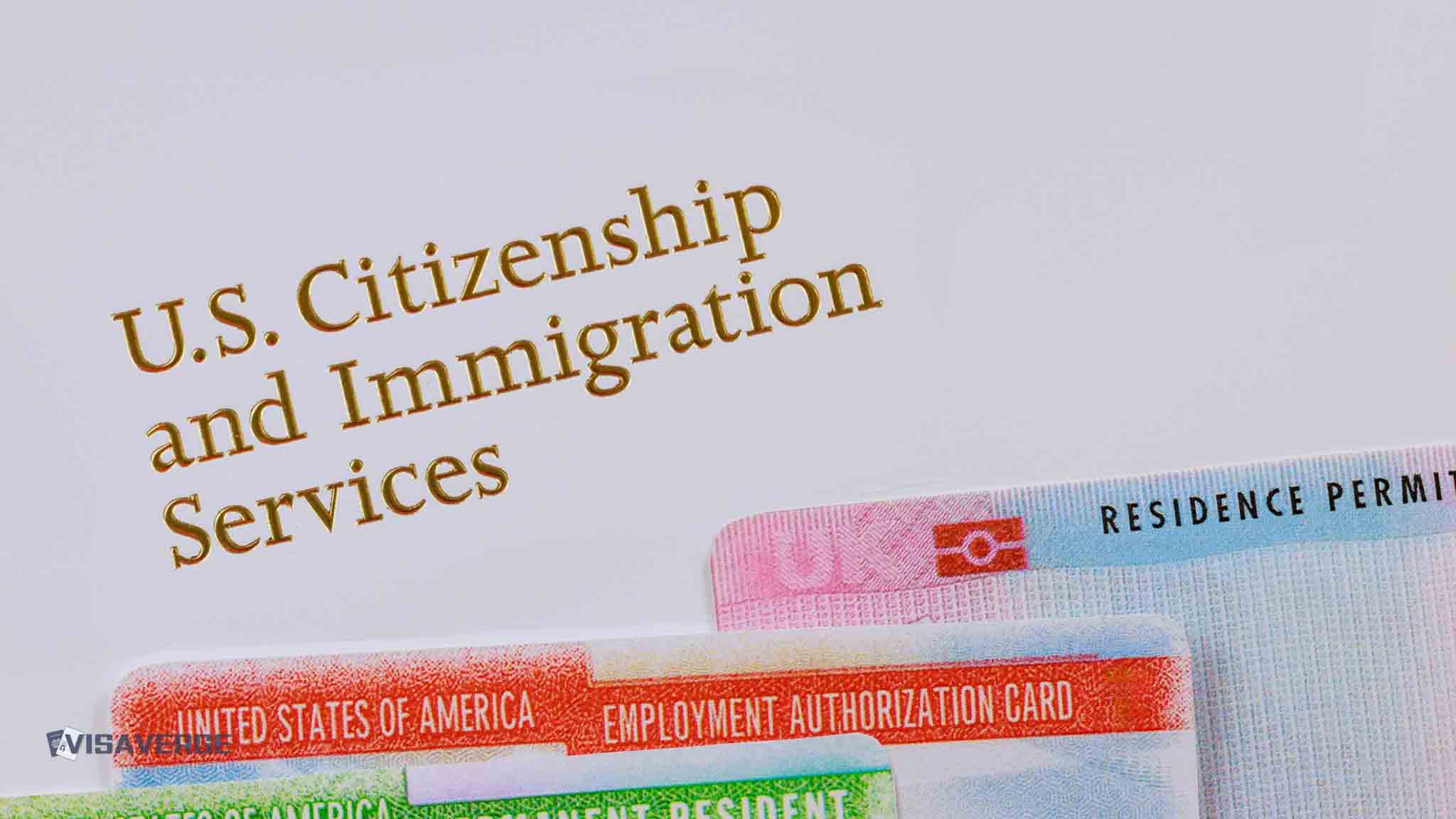

Green Card

Green Card category provides key information on permanent residency in the U.S., latest policy changes, and application strategies for a smooth transition.

DV-2027 Green Card Lottery: New $1 Fee, Passport Checks, and More

The DV-2027 lottery introduces a $1 registration fee and passport-at-entry requirement and moves the online registration to October–November 2025, keeping a 55,000 visa cap. Applicants should prepare documents early, avoid…

Trump’s Stricter Green Card Scrutiny: Should H-1B and LPRs Be Worried?

Effective September 21, 2025, new H-1B petitions incur a $100,000 one-time fee and stricter vetting; EAD automatic extensions…

Trump Gold Card Visa: Investor Requirements, Fees, and USCIS Vetting

The Trump Gold Card proposes a $1 million investor route to U.S. permanent residency with intensive USCIS vetting…

EB-2 NIW Delays for Indian Applicants: Yale PhD’s 2-Year Delay Ends

An EB-2 NIW filed by an Indian Yale PhD in October 2023 faced a 26-month delay. USCIS logged…

US Green Card Crackdown: New 2025 Policies Could Limit Eligibility

The 2025 OBBBA and agency directives greatly tighten U.S. immigration: $170 billion funds enforcement, USCIS paused some green…

Social Security Agreements: Why Global Indians Benefit in 2025

India seeks to widen its SSA network as expatriates and firms face double social security deductions and lost…

USCIS Tech Email Confusion Highlights Green Card Applicant Frustration

A misrouted USCIS developer bulletin mentioning API key rotation alarmed a green card holder but did not affect…

Thanksgiving Travel for Green Card Holders: Re-entry Rules

Permanent residents should avoid long absences around Thanksgiving because trips approaching six months can prompt CBP to question…

Year-End Tax Deductions for International Workers and Students

Before December 31, 2025, confirm tax residency to know whether to file Form 1040 or 1040-NR. Update withholding,…

Thanksgiving Travel Rush 2025: Essential Tips for Visa Holders

Record travel is expected for Thanksgiving 2025, peaking Nov. 26 and 30. Visa holders face extra screening; bring…