F1Visa

Explore F1Visa insights and guidelines for international students. Stay informed about application tips, regulations, and updates for studying in the U.S.

Harvard Sets International Student Record Despite Trump Administration Pressure

Despite federal funding freezes and regulatory challenges, Harvard University reported a record 6,749 international students for 2025–2026. This 28% share of the student body contrasts with a national decline in…

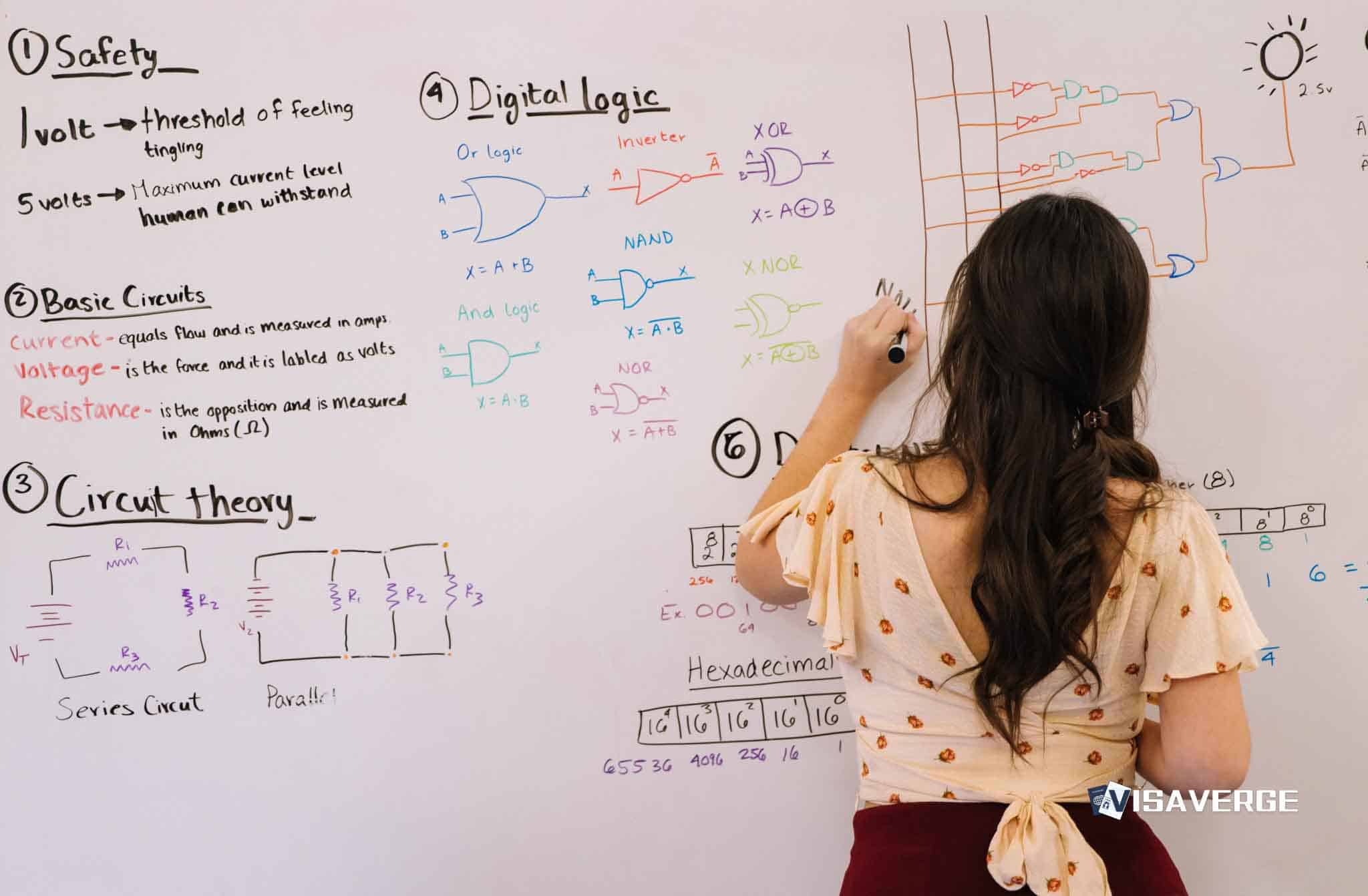

Understanding H-1B Cap Changes: Higher Wages and Faster Transitions

Transitioning from F-1 to H-1B status involves significant tax and regulatory changes. Graduates must navigate new residency rules,…

OPT Premium Delays Intensify Risk for F-1 Job Offers

Form I-765 allows F-1 students to apply for OPT and STEM OPT work authorization. Successful applications require a…

Will Wage-Based H-1B Rule Impact Master’s Cap Selection?

The new H-1B weighted-selection rule replaces random draws with a system favoring higher salaries. Candidates with higher OEWS…

What Immigrants and Students Should Know About U.S. Airport Inspections

New U.S. immigration policies effective late 2025 expand facial biometric requirements and enhance screening for work-visa holders. H-1B…

U.S. Taxes for Immigrants in 2026: Common Myths Debunked

Visa holders in 2026 face increased scrutiny regarding tax residency. Determining residency status is vital, as it triggers…

Master’s Degree in the U.S. 2026 Guide: Costs, Living, and Careers

A guide for 2026 U.S. Master's applicants covering the $100k-$160k budget requirement, the transition from F-1 to OPT,…

How to Secure Full Funding for US Studies: Strategies That Work

A comprehensive roadmap for international students seeking full funding in the U.S. It covers the 12-18 month planning…

Foreign student downturn strains university finances amid policy shifts

A 17% drop in international student enrollment is hitting U.S. universities hard. New DHS policies, such as replacing…

W-2 vs 1099: Navigating Employment Status for Immigrants

New 2025 regulations link USCIS records with IRS data, making tax compliance a cornerstone of immigration status. H-1B…