Documentation

Documentation simplified: Access expert guidance on visa and immigration paperwork. Get checklists, form overviews, and tips to ensure your documents are in order.

Guidelines for Indian Nationals Attending U.S. Visa Interviews

Verify your immigration status before any USCIS or consular appointment. Overstays and unauthorized work can prompt detention if records are shared with ICE. File timely extensions and keep proof, bring…

Airport Visa Revocation Triggers: Misrepresentation and Status

CBP can revoke a visa at entry; misrepresentation, status violations, employer inconsistencies, and device evidence drive revocations. 2025…

Canada’s 2025 Work Permit Extensions: Documentation and Compliance

In 2025 Canada requires stronger proof for work permit extensions—pay stubs, job letters, and attestations—and narrows family open…

Proving a Genuine Spousal Sponsorship in Canada: IRCC Evidence

Prove a genuine relationship by matching IRCC categories and submitting official documents, communication records, and personal statements. Common-law…

CBP biometric entry/exit to apply to all non-citizens

On Dec. 26, 2025, CBP will mandate live facial recognition scans for all non‑citizen travelers, including Green Card…

What to Do If CBP Separates You at the U.S. Airport

CBP separations usually lead to routine secondary inspection lasting 10 minutes to 2 hours. Stay calm, answer briefly…

Facing CBP at U.S. Ports: Honest, Brief Answers for B-1/B-2 Visitors

A successful B-1/B-2 entry relies on a short, consistent trip story and supporting documents like a return ticket…

UK ETA Enters Full Effect in February 2026 for Visa-Free Travelers

Starting February 25, 2026, many visa-free travelers must obtain a £16 ETA before boarding. Valid two years or…

US Immigration 2026: Visa-by-Visa Rules, Delays, and Prep Requirements

H-1B statutes remain, but 2026 brings tighter enforcement: more RFEs, site visits, slower processing (3–5 months average), and…

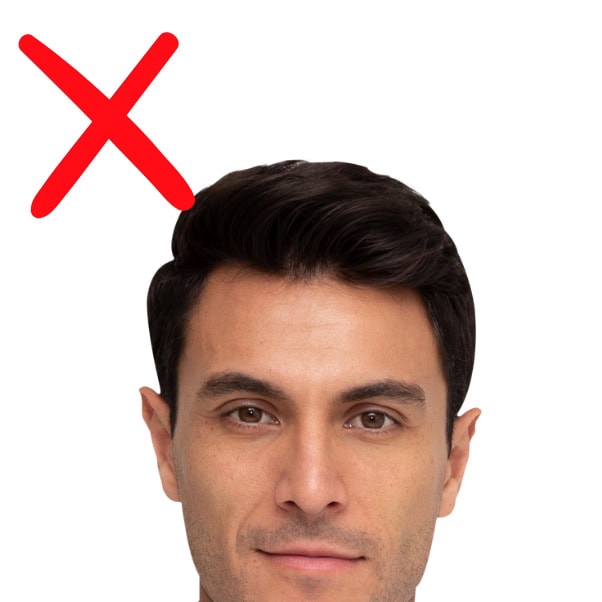

USCIS Reissues Photo Policy: 3-Year Freshness Rule for Most Filings

Effective December 12, 2025, USCIS will reuse photos only if taken within 36 months at an authorized biometric…