Documentation

Documentation simplified: Access expert guidance on visa and immigration paperwork. Get checklists, form overviews, and tips to ensure your documents are in order.

Delaware REAL ID for Immigrants 2026: DMV Requirements and Steps

Delaware immigrants must prepare for May 2025 REAL ID requirements by verifying their lawful presence through the SAVE system. Licenses will expire based on immigration status dates. To ensure approval,…

North Dakota REAL ID for Immigrants 2026: Requirements and Application

North Dakota requires immigrants to prove lawful presence and state residency with original documents to obtain a REAL…

Finland Raises PR Fees from Jan 1, 2026, with Citizenship Test

Starting January 2026, Finland will hike residence permit fees and implement stricter eligibility criteria, including higher income and…

USCIS Clarifies I-140 Requirements for Professional Athletes under FLAG

New USCIS policy requires professional sports teams to include specific job requirement details in green-card petitions. This follows…

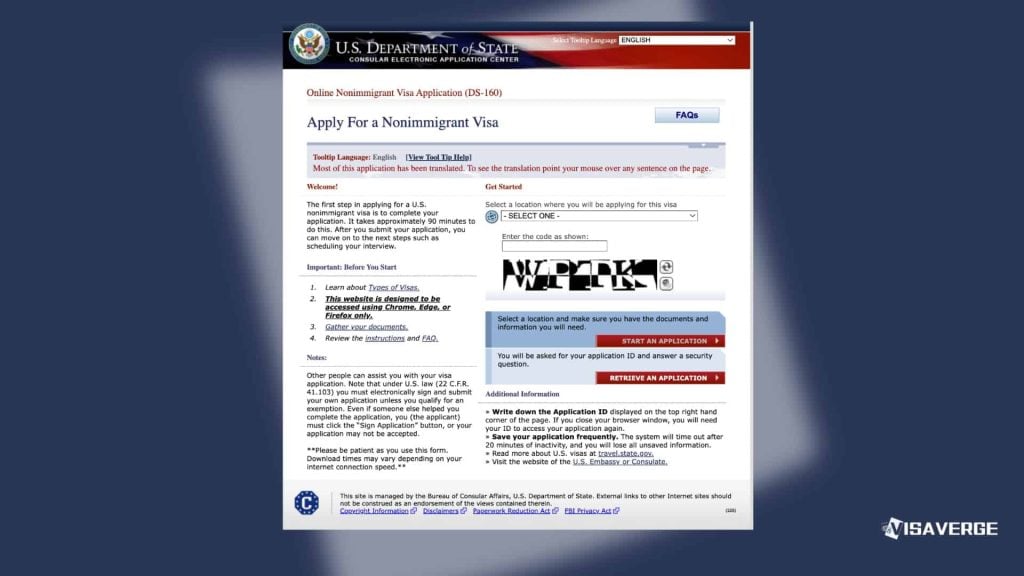

How to List Social Media for DS-160: Step-by-Step Instructions

Applying for a U.S. visa requires disclosing five years of social media history on the DS-160 form. Applicants…

Backdoor Roth IRA Mastery for High-Net-Worth Portfolios (2025–26)

The Backdoor Roth IRA allows high earners to bypass IRS income limits through a two-step contribution and conversion…

Worldwide H-1B and H-4 Visa Vetting Expands to All Applicants

The State Department will require social media and online presence checks for all H-1B and H-4 applicants applying…

India suspends visas in Chittagong indefinitely after attack on mission

The Indian Visa Application Center in Chittagong closed indefinitely on December 21, 2025, citing security concerns after attacks…

Available USCIS Forms Online Filing: Access, Fees, and Workflow

Many USCIS forms can now be filed through a free online account using guided forms or PDF uploads.…

EB-1 India Not Current in January 2026; Backlogged at 01FEB23

EB-1 India is not current in January 2026; the Final Action Date is 01FEB23 and Dates for Filing…