Documentation

Documentation simplified: Access expert guidance on visa and immigration paperwork. Get checklists, form overviews, and tips to ensure your documents are in order.

USCIS Clarifies I-140 Requirements for Professional Athletes under FLAG

New USCIS policy requires professional sports teams to include specific job requirement details in green-card petitions. This follows changes in the DOL's FLAG system that omitted these details from standard…

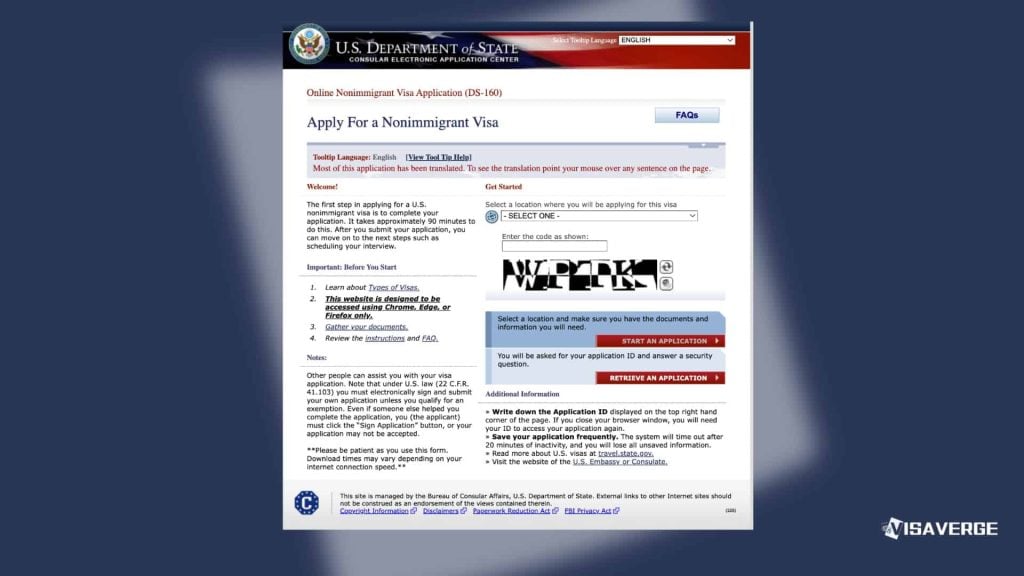

How to List Social Media for DS-160: Step-by-Step Instructions

Applying for a U.S. visa requires disclosing five years of social media history on the DS-160 form. Applicants…

Backdoor Roth IRA Mastery for High-Net-Worth Portfolios (2025–26)

The Backdoor Roth IRA allows high earners to bypass IRS income limits through a two-step contribution and conversion…

Worldwide H-1B and H-4 Visa Vetting Expands to All Applicants

The State Department will require social media and online presence checks for all H-1B and H-4 applicants applying…

India suspends visas in Chittagong indefinitely after attack on mission

The Indian Visa Application Center in Chittagong closed indefinitely on December 21, 2025, citing security concerns after attacks…

Available USCIS Forms Online Filing: Access, Fees, and Workflow

Many USCIS forms can now be filed through a free online account using guided forms or PDF uploads.…

EB-1 India Not Current in January 2026; Backlogged at 01FEB23

EB-1 India is not current in January 2026; the Final Action Date is 01FEB23 and Dates for Filing…

Hungary Adopts Qualified Electronic Signatures for Immigration Filings

Hungary now mandates QES plus a qualified timestamp for online immigration filings via Enter Hungary, replacing AVDH. Employers…

German Embassy Tehran Resumes Schengen Visa Applications on Jan 7 2026

Germany’s Tehran embassy will resume Schengen visa intake on January 7, 2026; TLScontact will open a waiting list…

Vietnam Revises Work Permit Rules Under Decree 219/2025

Vietnam’s Decree No. 219/2025 merges steps into one work-permit dossier, relaxes labor market testing for local hires, permits…