Anxiety Grips Minneapolis’ Somali Community as Federal Raids Intensify

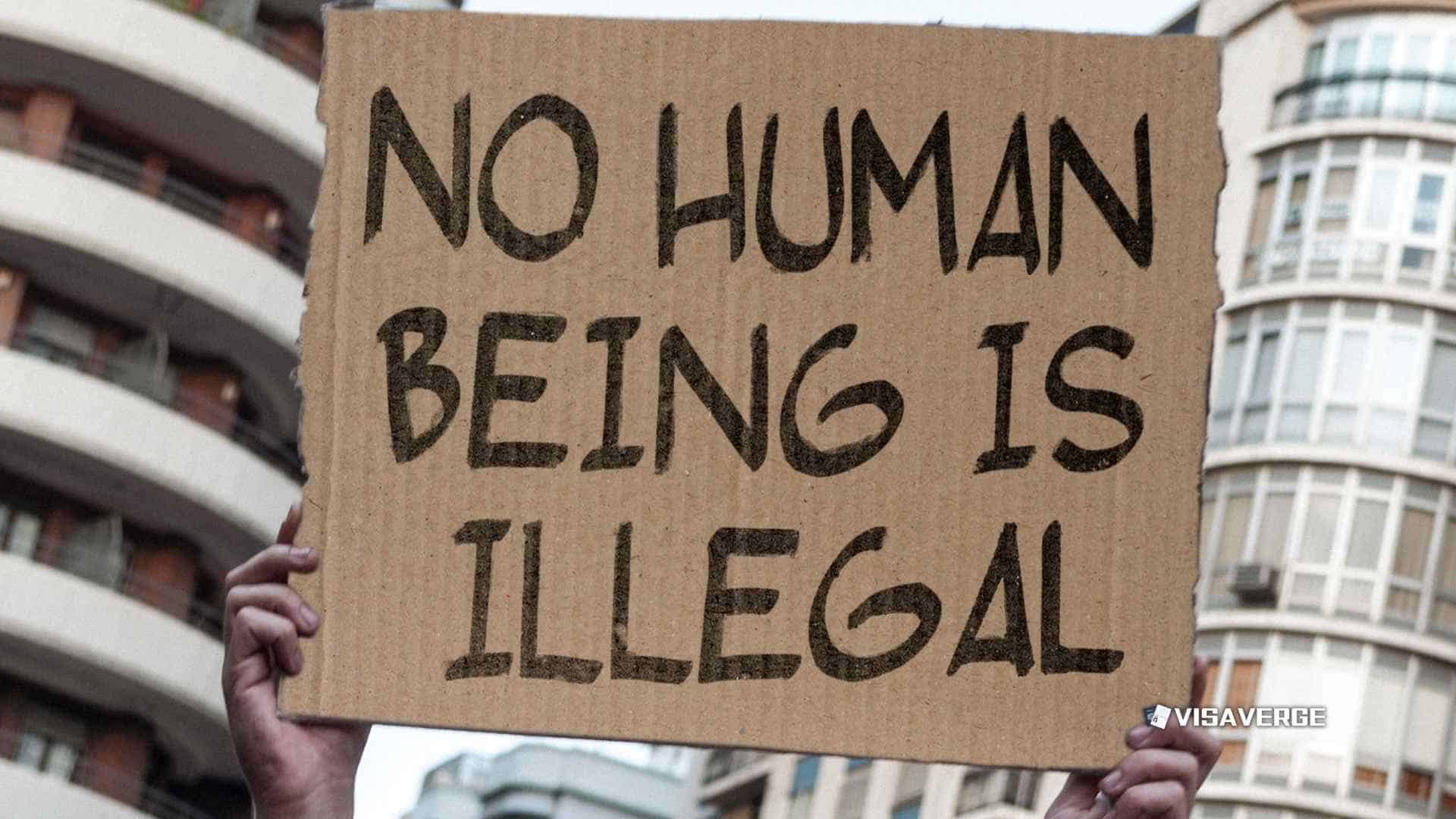

In early December 2025 federal raids in Minneapolis targeted Somali neighborhoods, cited by officials as linked to Medicare…

Robert Pyne, a Professional Writer at VisaVerge.com, brings a wealth of knowledge and a unique storytelling ability to the team. Specializing in long-form articles and in-depth analyses, Robert's writing offers comprehensive insights into various aspects of immigration and global travel. His work not only informs but also engages readers, providing them with a deeper understanding of the topics that matter most in the world of travel and immigration.

www.visaverge.com

In early December 2025 federal raids in Minneapolis targeted Somali neighborhoods, cited by officials as linked to Medicare…

Mid-2025 data show the D.C. crackdown detained mostly non-convicted individuals: about 30% had convictions, 27% had pending charges,…

Babson freshman Lucía López Belloza, brought to the U.S. at age 7, was detained Nov. 20 at Boston…

An April 2025 U.S. policy treating visa adjudications as national security decisions led to roughly 6,000 F-1 revocations,…

DHS agents performed surprise I‑9 audits at 187 D.C. restaurants in May 2025, demanding records within three days.…

Activists met with Centennial Airport over Key Lime Air’s role in ICE removals after Human Rights First reported…

A September 2025 proclamation requires employers to pay $100,000 for new H‑1B petitions filed for workers abroad, effective…

Swamp Sweep started Dec. 3, 2025, targeting up to 5,000 people with roughly 250 DHS agents in southeast…

A Dec. 1 winter storm and nor’easter produced 12,000+ delays and 1,000+ cancellations, hitting Chicago O’Hare hardest with…

A 45-minute network outage in Amadeus Altea disrupted check-in at major global airports. Manual processing limited some damage,…

Get weekly visa policy updates, processing time alerts, and expert analysis delivered to your inbox.