Supreme Court to decide citizenship for children born abroad to same-sex couples

In 2026, Ireland’s Supreme Court will decide if children born via donor-assisted reproduction to same-sex couples abroad can…

Robert Pyne, a Professional Writer at VisaVerge.com, brings a wealth of knowledge and a unique storytelling ability to the team. Specializing in long-form articles and in-depth analyses, Robert's writing offers comprehensive insights into various aspects of immigration and global travel. His work not only informs but also engages readers, providing them with a deeper understanding of the topics that matter most in the world of travel and immigration.

www.visaverge.com

In 2026, Ireland’s Supreme Court will decide if children born via donor-assisted reproduction to same-sex couples abroad can…

An executive order targeting birthright citizenship is currently blocked by federal courts. The policy faces criticism for failing…

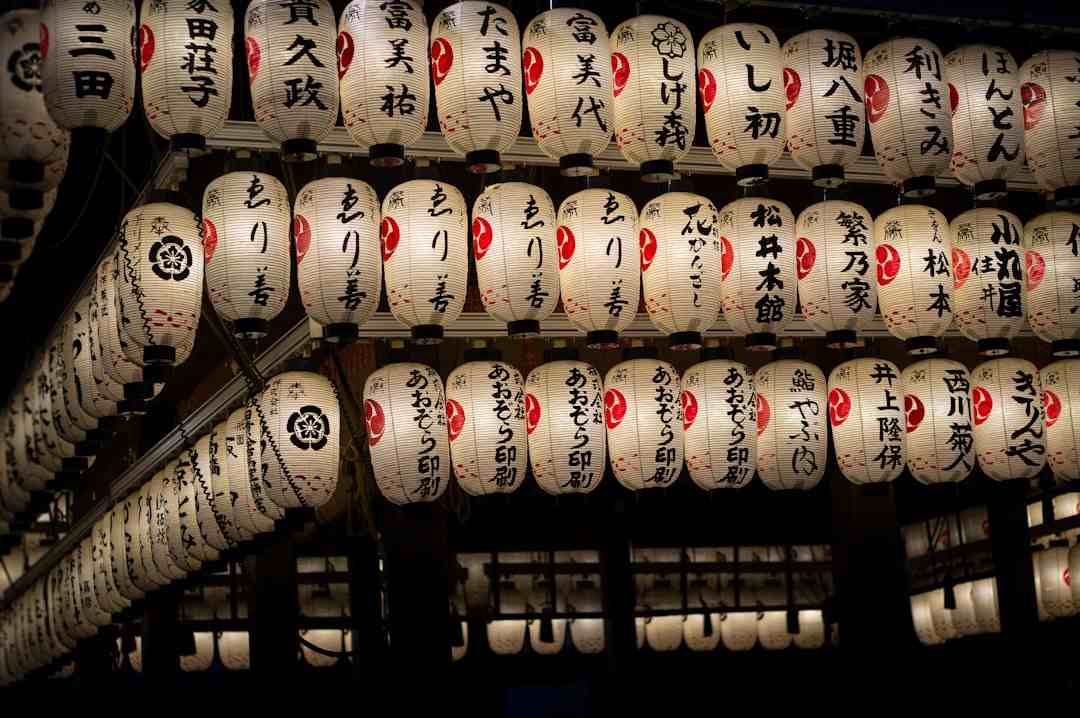

Rumors of a new Japanese language test for permanent residency are unfounded as of December 2025. The confusion…

Thirty-one Senators are urging the government to release the maximum number of supplemental H-2B visas for 2026. This…

British Airways' quick U-turn on its hot water bottle ban underscores the importance of staying updated on airline…

After a Starship breakup caused fuel emergencies for three passenger planes in January 2025, the FAA overhauled debris…

This guide explains how to seek asylum in Germany following the 2025 border enforcement surge. It details why…

San Francisco’s Immigration Court is mired in a crisis where hearing dates now reach 2030. Although the judge…

American Airlines is expanding its AI-powered flight hold program to major airports like DFW, CLT, ORD, and PHX.…

Get weekly visa policy updates, processing time alerts, and expert analysis delivered to your inbox.