Key Takeaways

- On April 2, 2025, President Trump announced a 10% baseline tariff on all imports, declaring a national economic emergency.

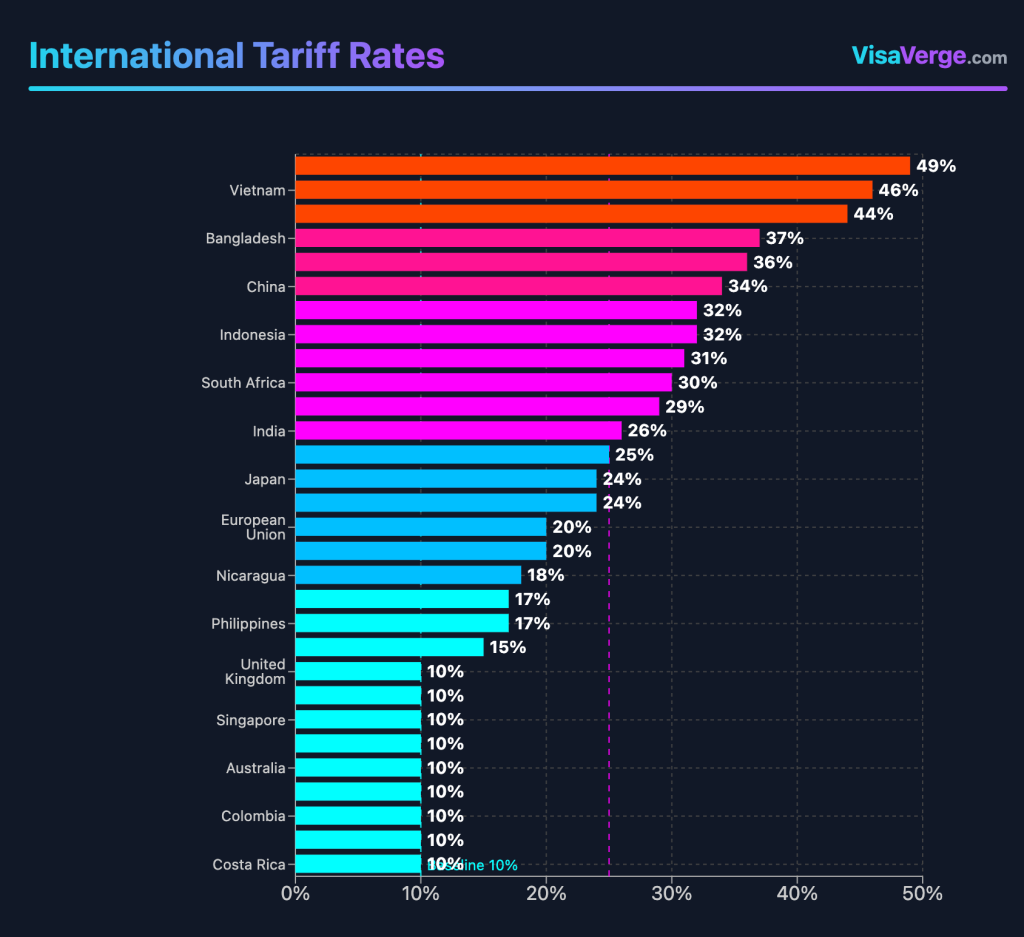

- Targeted higher tariffs include 34% on Chinese imports, 24% on Japanese goods, and 20% on European Union products.

- Tariffs aim to reduce the $1.2 trillion trade deficit, boost U.S. manufacturing, and address “unfair trade practices” like subsidies and IP theft.

On April 2, 2025, President Donald Trump made a major announcement, unveiling a 10% baseline tariff on all imports entering the United States. This bold step is part of a broader strategy aimed at addressing America’s trade deficit, boosting domestic manufacturing, and tackling what the administration has labeled as “unfair trade practices” by other nations. The measure includes higher tariff rates for specific countries, such as a 34% tariff on Chinese imports, 24% on Japanese goods, and 20% on products from the European Union (EU). To quickly implement these tariffs, President Trump declared a national economic emergency under the International Emergency Economic Powers Act, effectively bypassing the need for Congressional approval.

The announcement has triggered widespread discussion both inside the United States and around the world. While supporters argue this move could revive key U.S. industries and strengthen the domestic economy, critics are warning of inflation, price hikes for consumers, potential retaliation from trade partners, and even disruptions to the global economy. Here, we examine the details of this policy, its objectives, and the reactions it has sparked.

Key Elements and Goals of the Tariff Plan

The 10% tariff policy reflects President Trump’s vision of “reciprocal tariffs,” imposing measures that he says are intended to mirror the treatment that U.S. goods face in other nations. According to the administration, these tariffs will create a level playing field for American businesses while pressuring foreign governments to rethink their trade policies.

Tackling the Trade Deficit

One of the primary aims of these tariffs is to address the U.S. trade deficit, which reached a record $1.2 trillion in 2024. A trade deficit occurs when a country imports more than it exports, and it has been a key concern for President Trump, who has linked it to job losses and economic inequality. By raising the price of imported goods, Trump believes the tariffs will push businesses and consumers to turn to American-made alternatives, reducing reliance on foreign goods and shrinking the deficit over time.

Revitalizing Domestic Manufacturing

Much of President Trump’s campaign and policy platform has revolved around the idea of bringing manufacturing jobs back to the United States. The new tariffs specifically target sectors where the U.S. has seen economic decline over the decades, including steel, aluminum, automobiles, and semiconductors. By making imports more expensive, these measures are designed to encourage U.S.-based companies to invest in domestic facilities and workers rather than relying on cheaper foreign production.

Fighting “Unfair Trade Practices”

The United States has long criticized certain trade practices by major economies, including subsidies, intellectual property theft, and non-tariff barriers, such as complex regulations that disadvantage foreign imports. China has been a frequent target of U.S. grievances, particularly concerning its state-sponsored subsidies to support domestic industries and its handling of intellectual property rights. Similarly, the EU and Japan have faced criticism from the U.S. for policies that restrict access to their markets. By imposing targeted, higher tariffs on goods from these nations, the United States aims to push for policy changes abroad.

Economic Concerns: A Double-Edged Sword?

While the Trump administration has emphasized the potential benefits of these tariffs, many experts are cautioning about the possible negative consequences. The $600 billion in projected revenue from these tariffs may help fund certain programs, but the broader economic picture presents challenges.

Impact on Prices and Inflation

One of the most immediate effects American consumers are likely to feel is the increase in prices for everyday goods. Imported items such as electronics, clothing, and grocery products like wine and fresh fruit will likely cost more due to the tariffs. Analysts estimate that the average American family could see their annual expenses rise by $3,400 to $4,200 as a result of these higher prices. This surge in costs could spark inflation, hitting lower- and middle-income families the hardest.

Political Fallout

In the political arena, Trump’s tariffs have drawn bipartisan criticism. Many Republican lawmakers, while traditionally supporting free-market policies, see this move as conflicting with conservative ideals of minimal government intervention in trade. Democrats, on the other hand, have voiced concerns over the potential fallout for key allies affected by these measures, as well as the broader implications for international relations. Both sides worry about possible retaliation from trading partners and the risks of prolonged trade wars.

Consequences for Specific Industries

Industries that depend heavily on global supply chains, such as consumer electronics and auto manufacturing, are likely to face significant disruptions. Companies may need to shift their sourcing strategies, potentially increasing production costs, which could then be passed on to consumers. Meanwhile, sectors like shipping and logistics could experience volatility, as businesses adjust to the new price dynamics through methods such as rerouting goods or opting for more expensive alternatives like air freight.

International Impact: A Chain Reaction

As the United States implements these sweeping tariffs, the response from its trading partners has been swift and, in many cases, critical. Many affected economies are considering or have already imposed retaliatory tariffs on U.S. goods. This tit-for-tat approach could lead to even greater tension in global trade.

Retaliation from Key Partners

The EU, for example, has warned of counter-tariffs on American exports such as bourbon, motorcycles, and agricultural products, sending a clear signal that Europe intends to push back. Similarly, Canada and Mexico, both of which have deep trade ties with the U.S., are considering measures that could affect American agricultural and industrial exports. These moves have sparked concerns about rising tension with America’s closest neighbors. For instance, Canada’s tariffs are widely viewed as an effort to challenge Trump’s policies.

Effects in Asia

Asia’s major export-driven economies—including China, Japan, and South Korea—stand to face substantial challenges. China, hit hardest with a 34% tariff, has strongly condemned the move and is already working to diversify its trade relationships to reduce its dependence on U.S. markets. Japan and South Korea, which rely heavily on U.S. buyers for their automotive and electronics exports, are bracing for significant economic impacts as well.

Slower Global Growth

According to the Organization for Economic Co-operation and Development, the current policies could slow global economic growth, projecting rates of 3.1% for 2025 and 3.0% for 2026. Economies that depend on integrated global trade, such as Mexico and Vietnam, are particularly likely to feel the slowdown. Retaliatory actions, combined with rising costs for transportation and goods, may exacerbate these challenges.

International Tariff Rates

Universal Baseline Tariff

Imported Automobiles Tariff

Important Notes

- • The universal baseline tariff of 10% will apply to all imported goods regardless of country of origin, effective April 5, 2025.

- • The 25% tariff on all imported automobiles takes effect on April 3, 2025.

- • Country-specific rates shown in the chart are current rates before the new universal baseline is applied.

Historical Context: A Repeating Cycle?

Trump’s tariff announcement is the latest chapter in a long history of economic protectionism in the United States. Such strategies have been used before, with mixed results.

Lessons from History

The Smoot-Hawley Tariff Act of 1930 is one of the most cited examples of tariffs gone wrong. Designed to protect American industries during the Great Depression, it instead worsened the economic situation by provoking retaliatory measures from other nations, leading to a collapse in global trade. Critics today are concerned about the possibility of repeating such outcomes, though the interconnected nature of today’s global economy might help cushion the blow.

America First

President Trump’s latest move fits neatly within his broader “America First” agenda, which has focused on protecting American jobs while realigning global trade to favor the United States. Past measures, such as steel and aluminum tariffs, offered insights into how these policies might impact the economy, with mixed results in terms of both employment and costs to consumers.

What Comes Next?

As the U.S. embarks on this new trade policy, uncertainty hangs over the global economy. For American families, the immediate reality includes higher costs for goods and a hazy outlook for economic stability. For international trading partners, retaliatory measures introduce their own risks, as global markets become more fractious.

The long-term outcome of President Trump’s tariffs hinges largely on how both the United States and its allies navigate this turbulent period. Will these measures indeed reduce the trade deficit and revive domestic industries, or will they disrupt supply chains and hinder economic growth worldwide? For now, only time will tell.

For further information on tariff policies and their impact on trade, readers can visit USTR.gov, the official website of the United States Trade Representative.

As reported by VisaVerge.com, this moment in trade policy represents a turning point not just for the United States, but for global commerce as a whole.

Learn Today

Tariff → A tax imposed on imported or exported goods to regulate trade and generate revenue for a country.

Trade Deficit → The economic condition where a country imports more goods and services than it exports, creating an imbalance.

Reciprocal Tariffs → Trade measures mirroring the tariff policies of other countries to equalize treatment of imported and exported goods.

Intellectual Property Theft → Unauthorized use or replication of inventions, designs, or creative works, often impacting international trade relations.

International Emergency Economic Powers Act → U.S. law allowing the president to regulate international commerce during a declared national economic emergency.

This Article in a Nutshell

On April 2, 2025, President Trump introduced a 10% tariff on all U.S. imports, with higher rates for China, Japan, and the EU. Aimed at reducing the $1.2 trillion trade deficit and reviving domestic manufacturing, critics warn of inflation, trade wars, and global disruption. Will this bold move succeed? Time reveals.

— By VisaVerge.com

Read more:

• China, Japan, South Korea Plan Joint Action on U.S. Tariffs

• US Allies Push Back Against Trump’s Car Tariffs, Hint at Retaliation

• India Offers Tariff Cuts on US Farm Goods, Aims to Boost Trade Ties

• Canada Runs ‘Tariffs Are a Tax’ Ads in U.S., Challenges Trump Policy

• Trump warns of higher tariffs on EU and Canada for teaming up against the U.S.