Key Takeaways:

Navigating federal income tax as an H1B visa holder: understanding tax brackets, calculations, and visa-specific considerations to stay compliant.

Important aspects: resident alien status, 2023 federal tax brackets, visa-specific tax implications, staying compliant and seeking professional guidance.

Navigating the Federal Income Tax Brackets for H1B Visa Holders

Understanding the tax obligations that come with working in the United States on an H1B visa is crucial. If you’re an H1B visa holder, it’s important to know how you’ll be affected during tax season. This article provides a detailed look at the federal income tax brackets specifically for H1B visa holders and offers insights into how H1B visas affect federal tax filing.

Federal Income Tax Overview for H1B Visa Holders

As an H1B visa holder, you are considered a resident alien for tax purposes if you pass the Substantial Presence Test—which generally means spending at least 31 days in the U.S. during the current year and a total of 183 days during a three-year period including the current year and the two years immediately before. Meeting this criterion means you’re required to pay federal income taxes on your worldwide income.

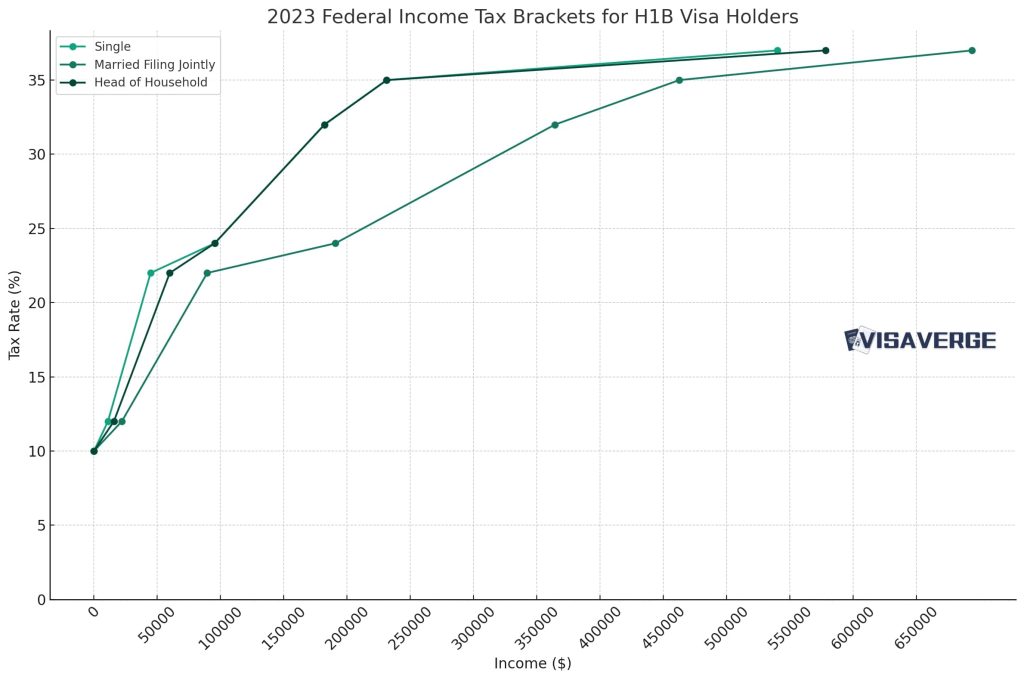

2023/2024 Federal Tax Brackets

The federal tax brackets are progressive, meaning that as your income increases, so does your tax rate. Below are the tax brackets for the 2023 tax year, which you would use to file your taxes in 2024:

| Tax Rate | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | $0 to $11,000 | $0 to $22,000 | $0 to $15,700 |

| 12% | $11,000 to $44,725 | $22,000 to $89,450 | $15,700 to $59,850 |

| 22% | $44,725 to $95,375 | $89,450 to $190,750 | $59,850 to $95,350 |

| 24% | $95,375 to $182,100 | $190,750 to $364,200 | $95,350 to $182,100 |

| 32% | $182,100 to $231,250 | $364,200 to $462,500 | $182,100 to $231,250 |

| 35% | $231,250 to $539,900 | $462,500 to $693,750 | $231,250 to $578,100 |

| 37% | over $539,901 | over $693,750 | over $523,601 |

For Single Filers:

- 10% for income between $0 to $11,000

- 12% for income over $11,000 to $44,725

- 22% for income over $44,725 to $95,375

- 24% for income over $95,375 to $182,100

- 32% for income over $182,100 to $231,250

- 35% for income over $231,250 to $539,900

- 37% for income over $539,900

For Married Filing Jointly:

- 10% for income between $0 to $22,000

- 12% for income over $22,000 to $89,450

- 22% for income over $89,450 to $190,750

- 24% for income over $190,750 to $364,200

- 32% for income over $364,200 to $462,500

- 35% for income over $462,500 to $693,750

- 37% for income over $693,750

Head of Household:

- 10% for income between $0 to $15,700

- 12% for income over $15,700 to $59,850

- 22% for income over $59,850 to $95,350

- 24% for income over $95,350 to $182,100

- 32% for income over $182,100 to $231,250

- 35% for income over $231,250 to $578,100

- 37% for income over $578,100

Remember that these rates apply to taxable income, which is your gross income after subtracting the standard or itemized deductions and any exemptions you may be eligible for.

Federal Income Tax Calculations for H1B Visa Holders

To better understand how these tax brackets apply to you, let’s look at a hypothetical situation. If you’re single and your annual taxable income is $60,000, your federal income tax calculation would be as follows:

- On the first $11,000, you pay 10%, which is $1,100.

- You then pay 12% on the amount over $11,000 up to $44,725, which comes to $4,047 (12% of $33,725).

- Lastly, you pay 22% on the amount over $44,725, which is $3,360.50 (22% of $15,275).

Adding these amounts together gives you a total federal income tax liability of $8,507.50.

It’s also vital to understand that these brackets do not account for other potential taxes, such as state and local taxes, Social Security, and Medicare taxes that may apply to your situation.

How H1B Visas Affect Federal Tax Filing

If you’re on an H1B visa, you may wonder how this status impacts your taxes beyond just the rates above.

- FICA Taxes: As an H1B visa holder, you’re subject to FICA taxes, which include Social Security and Medicare.

- Double Taxation Treaties: The U.S. has income tax treaties with various countries that can offer relief from double taxation for H1B visa holders.

- Nonresident Aliens: If you do not meet the Substantial Presence Test, you may be considered a nonresident alien and be subject to a different set of tax rules.

- Standard Deduction: For the tax year 2021, the standard deduction is $12,550 for single filers and $25,100 for married couples filing jointly.

Staying Compliant with Your Tax Obligations

Staying compliant with the U.S. tax laws is essential. It’s a good idea to consult with a tax professional who specializes in working with H1B visa holders to ensure you’re taking advantage of all applicable deductions and credits and properly filing your tax return.

Remember, the information provided here is for the 2023 tax year. It’s important to stay updated as tax laws and brackets can change from year to year.

For official resources and guidance on federal income tax, you can visit the Internal Revenue Service (IRS) website.

Final Takeaways

The U.S. tax system can be complex, especially for those new to the country or its tax laws. Knowing and understanding the H1B visa tax brackets is the first step toward making sure you meet your tax responsibilities.

For further information and assistance, please reach out to the IRS or a tax professional experienced in handling federal income tax calculations for H1B visa holders. This step ensures you not only comply with the law but also maximize your deductions and credits.

Make sure to keep all your documentations and tax records in order, and consider getting professional help if you need clarification on how to file your taxes properly. Filing correctly can save you a significant amount of money and avoid any potential legal issues with your visa status.

Still Got Questions? Read Below to Know More

Are there any special tax forms that H1B workers need to fill out when filing their taxes?

Yes, H1B workers have specific tax forms they need to fill out when filing their taxes in the United States. As non-resident or resident aliens for tax purposes, H1B visa holders need to determine their tax status first. Here are the basic forms they may have to file:

- Form W-2: This form reports income earned and taxes withheld by your employer.

- Form 1040 or 1040-NR: The standard federal income tax form is Form 1040, but non-resident aliens file Form 1040-NR.

- Form 8843: If you are a non-resident alien in the U.S. for tax purposes, you must file this form to explain your tax-exempt status.

- State tax returns: Depending on the state you live in, you might need to file a state tax return as well.

Non-resident aliens typically cannot claim the same deductions and credits available to resident aliens or U.S citizens. It’s important to note that H1B workers may become resident aliens for tax purposes if they meet the substantial presence test, which involves being physically present in the U.S. for at least 31 days during the current year and 183 days during the three-year period that includes the current year and the two years immediately before that.

For detailed instructions on which forms to use and how to file, you can refer to the IRS Publication 519, “U.S. Tax Guide for Aliens,” or consult a tax professional who is familiar with the unique tax situations of H1B workers. Find official information and downloadable forms at the IRS website: Internal Revenue Service (IRS). It’s crucial to comply with all tax requirements to maintain your immigration status and avoid any legal complications.

Can H1B visa holders claim their children as dependents to reduce their tax liability?

Yes, H1B visa holders can generally claim their children as dependents on their U.S. tax returns to reduce their tax liability, provided certain conditions are met. To claim a dependent, your child must:

- Have a valid ITIN (Individual Taxpayer Identification Number) or SSN (Social Security Number).

- Be under the age of 19 at the end of the year, or under 24 if a full-time student.

- Live with you in the United States for more than half the year.

- Not provide over half of their own support for the year.

- Be a U.S. citizen, U.S. national, or resident alien.

“If the child is a resident alien, they generally have the same tax treatment as U.S. citizens. This means that they would typically be eligible for the same tax benefits,” according to the Internal Revenue Service (IRS). Nonresident aliens, which some H1B holders may be categorized as, typically cannot claim the standard deduction for a dependent.

For more detailed information and requirements, H1B visa holders can consult the IRS’s guidelines on dependents, which are available at the IRS website. It’s advisable to seek guidance from a tax professional or use reputable tax software to ensure correct filing. Remember, tax laws are complex and subject to change, so it’s important to stay informed on the latest tax regulations.

If I just got my H1B visa this year, how do I figure out if I pass the Substantial Presence Test for taxes?

The Substantial Presence Test is a criterion used by the Internal Revenue Service (IRS) to determine whether an individual should be taxed as a resident alien or a nonresident alien in the United States. You can figure out if you pass the Substantial Presence Test by doing the following:

- Calculate the total number of days you were present in the U.S. during the current year.

- Calculate the number of days for the two preceding years, but count each day as one-third in the first preceding year and each day as one-sixth in the second preceding year.

- Add the totals together. If the sum is 183 days or more, and you were present in the U.S. for at least 31 days during the current year, you pass the Substantial Presence Test and will be considered a resident alien for tax purposes.

Keep in mind that there are exceptions to this rule, such as for diplomats, certain students, and professional athletes competing in charitable sports events, among others.

Here’s an example calculation for the year 2023:

– Days in U.S. during 2023 = 150 days (Current Year)

– Days in U.S. during 2022 = 60 days ÷ 3 = 20 days (First Preceding Year)

– Days in U.S. during 2021 = 30 days ÷ 6 = 5 days (Second Preceding Year)

– Total = 150 + 20 + 5 = 175 days

In this example, the individual does not pass the Substantial Presence Test, as the total is less than 183 days.

For detailed information and for calculating your days accurately, it’s best to refer to the official IRS guidelines on the Substantial Presence Test, which can be found at the following link: IRS – Substantial Presence Test.

If you find the calculations challenging or if your situation involves complexities, it’s always best to consult with a tax professional or an immigration lawyer who can provide guidance tailored to your specific circumstances.

How do state taxes work for H1B visa holders; do they follow the same rules as federal taxes?

H1B visa holders are considered resident aliens for tax purposes if they meet the substantial presence test, which typically involves being physically present in the U.S. for at least 31 days during the current year and 183 days during the three-year period that includes the current year and the two years immediately before. If an H1B visa holder meets this test, they are subject to federal and state taxes similar to U.S. citizens and permanent residents.

Regarding state taxes, H1B visa holders generally follow the same rules as other residents of the state. Here’s a basic rundown:

- Residency for Tax Purposes: Each state has its own rules defining residency for tax purposes. If an H1B visa holder is considered a resident of a state, they must pay state income tax on all their income, regardless of where it was earned, subject to the tax laws of that state.

State Tax Returns: H1B holders must file state income tax returns if they earn income in a state that has income tax. Not all states require individuals to pay income taxes; states like Florida, Texas, and Nevada do not have a state income tax.

Reciprocal Agreements: Some states have reciprocal agreements with each other that allow residents of one state to request exemption from tax withholding in another state.

It’s important for H1B holders to understand the tax laws of their state of residence. For instance, California may have different tax regulations compared to New York or Illinois. Taxpayers are advised to consult a tax professional or refer to the state’s department of revenue or taxation website for specific guidance.

For federal taxes, the Internal Revenue Service (IRS) is the authoritative source for federal tax obligations. H1B visa holders can refer to official IRS resources for information on how to file federal taxes and understand their tax requirements.

For state-level information, it is recommended to visit the official website of the state’s revenue department for tax forms and instructions. For specific guidelines relevant to individual situations, it is advisable to consult with a tax professional who is familiar with both federal and state tax regulations for nonresident and resident aliens.

If I lost my job on an H1B visa midway through the year, how does this affect my tax filing and brackets?

Losing your job while on an H1B visa can indeed be a stressful situation, but when it comes to tax filing, the process remains quite straightforward. Here’s what you need to know:

- Filing your taxes: You’re still required to file your tax return with the IRS, irrespective of your employment status, as long as you’ve earned income during the tax year in the United States.

- Tax brackets: Your tax bracket might change if the income you’ve earned until the point of losing your job falls within a different bracket than it would have if you had continued to remain employed throughout the entire year. However, tax brackets are determined by your total annual income, so if your income decreases, you may fall into a lower tax bracket which could potentially reduce your overall tax liability.

- Unemployment duration: The duration of unemployment will not affect your tax bracket directly; however, any unemployment compensation you receive may be taxable. It’s important to include such details accurately in your tax return.

“If you are laid off or lose your job, it does not immediately affect your immigration status. You may be eligible for a grace period or may have to apply for a change of status,” according to the U.S. Citizenship and Immigration Services (USCIS). Make sure to maintain your immigration status by following the appropriate steps recommended by USCIS if your employment situation has changed.

Always refer to the official IRS guidelines for detailed instructions on how to file your taxes. It’s a good idea to seek advice from a tax professional who is versed in H1B visa issues to ensure that you comply with all the tax regulations and take into account any tax treaty benefits applicable to your situation.

For more information on H1B visa status and compliance, visit the official USCIS website: US Citizenship and Immigration Services (USCIS).

For tax bracket information and tax filing guidelines, you may refer to the Internal Revenue Service (IRS) official website: IRS.

Learn Today:

Glossary or Definitions

- H1B Visa: A non-immigrant work visa that allows U.S. employers to hire foreign workers in specialty occupations for a specific period, typically three years, with the possibility of extension.

Resident Alien: An individual who is not a U.S. citizen but meets the criteria established by the IRS to be considered a resident for tax purposes. H1B visa holders who pass the Substantial Presence Test are classified as resident aliens for tax purposes.

Substantial Presence Test: A test used by the IRS to determine whether a non-citizen individual is considered a resident alien for tax purposes. It is based on the number of days a person spends in the U.S. over a three-year period.

Federal Income Tax: A tax imposed by the U.S. government on an individual’s income, including wages, salaries, investments, and other sources of income.

Tax Brackets: A range of income levels that determine the tax rate and amount an individual owes. The U.S. federal income tax system uses progressive tax brackets, meaning that higher income levels are subject to higher tax rates.

Single Filer: A tax filing status for individuals who are not married and do not qualify for any other filing status.

Married Filing Jointly: A tax filing status for married couples who choose to file a joint tax return. It allows them to combine their incomes and deductions for tax purposes.

Head of Household: A tax filing status for individuals who are single or considered unmarried for tax purposes, have dependents, and pay for more than half of the cost of maintaining a home for themselves and their dependents.

Gross Income: The total income an individual earns from all sources before deductions or exemptions are applied.

Taxable Income: The portion of an individual’s income that is subject to taxation after deductions and exemptions have been applied.

Standard Deduction: A fixed amount that reduces the taxable income of taxpayers who choose not to itemize deductions on their tax return. The standard deduction is predetermined by the IRS and varies based on the individual’s filing status.

FICA Taxes: Federal Insurance Contributions Act taxes, which include Social Security and Medicare taxes. H1B visa holders are subject to FICA taxes.

Double Taxation Treaties: Agreements between the U.S. and other countries to prevent individuals from being taxed on the same income by both countries. Double taxation treaties may provide relief from double taxation for H1B visa holders.

Nonresident Alien: An individual who does not meet the Substantial Presence Test and is not considered a resident alien for tax purposes. Nonresident aliens are subject to different tax rules.

Tax Professional: An individual with expertise in tax laws and regulations who can provide guidance and assistance in preparing and filing tax returns. It is recommended for H1B visa holders to consult a tax professional to ensure compliance with tax laws and optimize deductions and credits.

Internal Revenue Service (IRS): The U.S. government agency responsible for administering and enforcing federal tax laws. The IRS provides resources and guidance on federal income tax, including forms and instructions for filing tax returns.

Tax Liability: The total amount of taxes owed by an individual or entity after deducting any credits and applying the appropriate tax rates.

Tax Return: A form or document filed with the IRS that reports an individual’s income and other relevant information necessary to calculate the tax liability. Taxpayers must file a tax return annually.

Tax Season: The period of time designated for filing tax returns, typically between January 1 and April 15 of each year, during which individuals and businesses are required to report their income and pay any taxes owed.

Tax Compliance: The act of following and abiding by all applicable tax laws and regulations, including accurately reporting income, claiming deductions and credits, and paying taxes on time. It is important for H1B visa holders to stay compliant with U.S. tax laws to avoid legal issues and maintain their visa status.

So there you have it—the ins and outs of navigating the federal income tax brackets for H1B visa holders. Understanding your tax obligations is crucial, but don’t worry, it’s not as daunting as it seems. Just remember to stay updated on any changes in the tax laws, consult a tax professional for expert advice, and visit visaverge.com for more information on H1B visas and immigration-related topics. Happy filing!

This Article in a Nutshell:

Understanding your tax obligations as an H1B visa holder is crucial. You’ll be considered a resident alien for tax purposes if you meet the Substantial Presence Test. The 2021 federal income tax brackets vary based on filing status, with rates ranging from 10% to 37%. Work with a tax professional to ensure compliance.