Key Takeaways:

- Understanding the 2024 minimum wage increases is crucial for workers, employers, and those considering immigration or work visas.

- State and city minimum wage changes in 2024 will impact compliance and the livelihood of workers.

- Employers must comply with tipped minimum wage requirements for industries relying on tipped employees.

Understanding the 2024 Minimum Wage Increases

As we move towards greater economic adjustments, it’s important for employees and employers alike to stay informed about the upcoming changes to minimum wages across various states and cities. Come January 1, 2024, several localities are set to increase their minimum wage rates, which could significantly affect the workforce and business operations.

Impact of Minimum Wage Changes on Immigration and Work Visas

Foreign workers and immigrants play a vital role in the U.S. labor market. For those on work visas or considering immigration for employment, understanding the 2024 minimum wage increases is crucial. Higher wage standards may impact visa eligibility and requirements, as well as influence decisions for both workers seeking employment in the U.S. and employers hiring foreign talent.

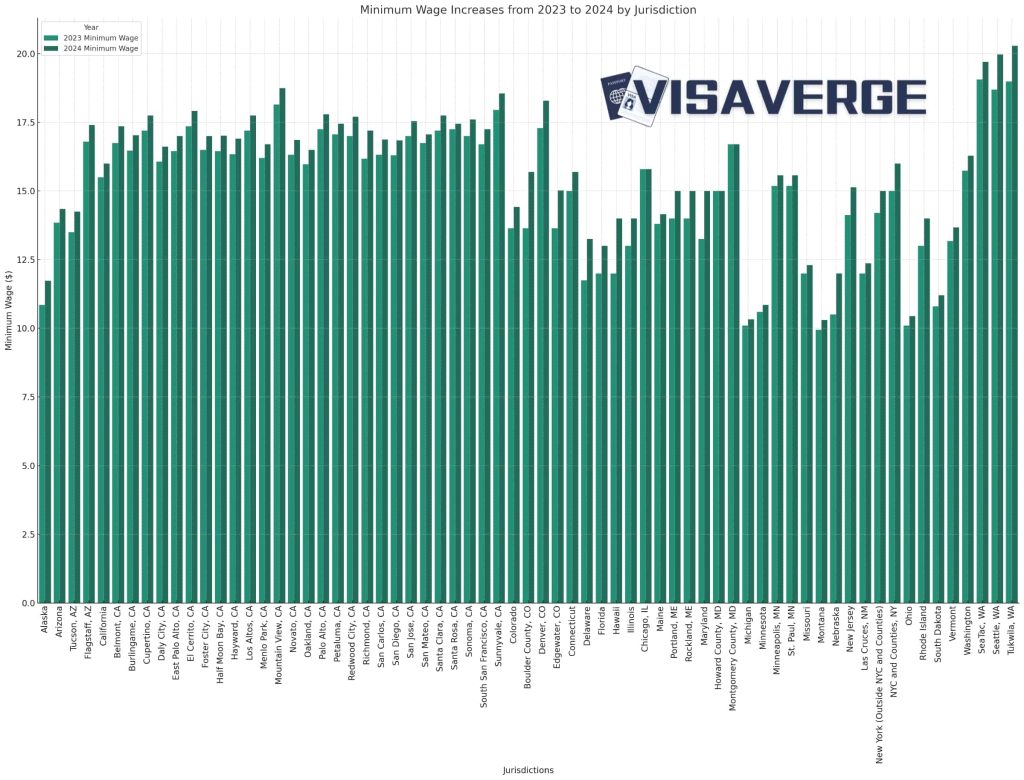

State and City Minimum Wage Changes in 2024

The scheduled state and city minimum wage changes 2024 serve as a vital guide for individuals and businesses to adapt accordingly. Each state and city has its own legislation dictating minimum wage, and these rates can be subject to annual increases. These adjustments are not only important from a compliance standpoint but also affect the livelihood of millions of workers.

For exact rates and detailed information, it’s highly recommended to visit the official state government websites or the U.S. Department of Labor. This official source provides a comprehensive view of current rates that are regularly updated in response to new legislation.

Tipped Minimum Wage Compliance for Employers in 2024

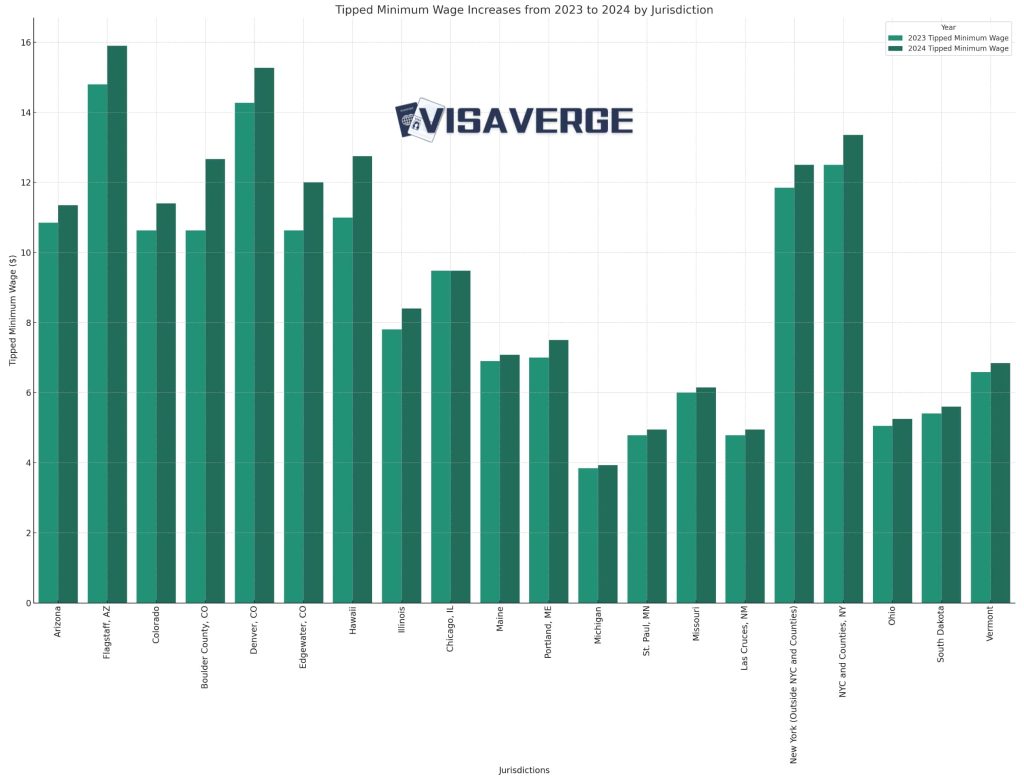

| Jurisdictions | 2023 Tipped Minimum Wage | 2024 Tipped Minimum Wage |

|---|---|---|

| Arizona | $10.85 | $11.35 |

| Flagstaff, AZ | $14.80 | $15.90 |

| Colorado | $10.63 | $11.40 |

| Boulder County, CO | $10.63 | $12.67 |

| Denver, CO | $14.27 | $15.27 |

| Edgewater, CO | $10.63 | $12.00 |

| Hawaii | $11.00 | $12.75 |

| Illinois | $7.80 | $8.40 |

| Chicago, IL | $9.48 (for large employers of 21 or more employees) | |

| $9.00 (for small employers of 4 to 20 employees) | ||

| Tip credit may not exceed 32% of the Chicago minimum wage (for all employers effective July 1, 2024) | ||

| Maine | $6.90 | $7.08 |

| Portland, ME | $7.00 | $7.50 |

| Michigan | $3.84 | $3.93 |

| St. Paul, MN | $4.78 | $4.95 |

| Missouri | $6.00 | $6.15 |

| Las Cruces, NM | $4.78 | $4.95 |

| New York (Outside New York City, and Long Island and Westchester Counties) | $11.85 Cash Wage and $2.35 Tip Credit (for tipped service employees) | |

| $9.45 Cash Wage and $4.75 Tip Credit (for tipped food service workers) | ||

| $12.50 Cash Wage and $2.50 Tip Credit (for tipped service employees) | ||

| $10.00 Cash Wage and $5.00 Tip Credit (for tipped food service workers) | ||

| New York City, and Long Island and Westchester Counties, NY | $12.50 Cash Wage and $2.50 Tip Credit (for tipped service employees) | |

| $10.00 Cash Wage and $5.00 Tip Credit (for tipped food service workers) | ||

| $13.35 Cash Wage and $2.65 Tip Credit (for tipped service employees) | ||

| $10.65 Cash Wage and $5.35 Tip Credit (for tipped food service workers) | ||

| Ohio | $5.05 | $5.25 |

| South Dakota | $5.40 | $5.60 |

| Vermont | $6.59 | $6.84 |

Particularly for industries reliant on tipped employees, like restaurants and hospitality, the tipped minimum wage compliance for employers 2024 remains a critical aspect to address. Employers must ensure they are up to date with the latest legal requirements not just for standard minimum wages, but also for the subminimum wages applicable to tipped employees.

If you are an employer with tipped staff, it is of paramount importance to understand how these increases will affect your payroll. Non-compliance could result in significant legal consequences. Resources such as The U.S. Department of Labor’s Wage and Hour Division can provide guidance on the rules surrounding tipped employees and minimum wage.

Preparing for the Transition

Here’s a concise checklist to help you prepare for the incoming wage increases:

- Stay Informed: Regularly check state or city labor department updates.

- Adjust Budgets: Plan for increased labor costs in your 2024 budget.

- Update Payroll Systems: Ensure your payroll provider is aware of the changes and ready to implement them.

- Communicate with Employees: Keep your workforce informed about how their wages will be affected.

- Consult Experts: If in doubt, seek advice from labor law experts or immigration attorneys.

Final Thoughts

Minimum wage increases reflect changes in the cost of living and economic conditions. While they can present challenges for businesses, they are also designed to ensure a fair wage for workers. As we enter another year of economic evolution, remaining vigilant and proactive about these changes is the key to successful adaptation.

For foreign workers and employers within the immigration sphere, knowledge of the minimum wage landscape is indispensable. Making informed decisions requires clarity on how immigration policies and employment laws intersect. As we look at the implications of the 2024 minimum wage modifications, let us remember the importance of lawful compensation in fostering robust labor markets and fair employment opportunities.

For those seeking detailed, authoritative advice on travel conditions, visa rules, and work visas, or other immigration needs, it’s recommended to consult official resources such as U.S. Citizenship and Immigration Services (USCIS) or legal experts who specialize in immigration law. These resources provide accurate and up-to-date information designed to guide you through the complexities of immigration and employment in the United States.

Learn Today:

Glossary

- 2024 Minimum Wage Increases: Refers to the scheduled changes in minimum wage rates that will take effect on January 1, 2024, in various states and cities. These changes can have an impact on the labor market, including visa eligibility and requirements for foreign workers and immigrants.

- State and City Minimum Wage Changes 2024: The adjustments to minimum wage rates that are specific to individual states and cities. Each jurisdiction has its own legislation that determines the minimum wage, and these rates may be subject to annual increases. Staying informed about these changes is important for compliance and can affect the livelihood of workers.

- Tipped Minimum Wage Compliance for Employers 2024: Refers to the legal requirements that employers must adhere to regarding minimum wage for tipped employees. Certain industries, such as restaurants and hospitality, rely on tips as part of employees’ compensation. Employers need to be aware of the subminimum wages applicable to tipped employees in addition to standard minimum wage regulations.

- Compliance: Refers to the act of conforming to the laws, regulations, and policies set forth by the government. In the context of minimum wage, compliance involves ensuring that employers meet the legal requirements for paying their employees a specified minimum wage.

- Immigration: The process of individuals moving from one country to another in order to establish permanent residence, seek employment, reunite with family, or pursue other opportunities. Immigration involves undergoing specific legal procedures and meeting certain requirements, such as obtaining visas or work permits.

- Work Visas: Legal documents issued by a government that allow foreign nationals to work in a particular country for a specified period. Work visas are typically granted based on employment sponsorship and may have specific terms and conditions, including eligibility criteria and restrictions on the type of work that can be performed.

- Labor Market: The supply and demand for labor within an economy. It encompasses all individuals who are available for work, as well as the employment opportunities provided by businesses and organizations.

- Compliance standpoint: Refers to the perspective of ensuring that an individual or organization adheres to the legal and regulatory requirements governing a specific area, such as minimum wage laws.

- Payroll: The process of calculating and disbursing wages or salaries to employees. It involves tasks such as recording hours worked, applying the appropriate pay rates, and deducting taxes or other withholdings.

- Labor Law Experts: Professionals who specialize in the field of labor law, which encompasses legal regulations and protections related to employment, wages, working conditions, and the relationships between employers and employees.

- Immigration Attorneys: Lawyers who specialize in immigration law and provide legal advice and guidance to individuals, employers, and organizations regarding immigration-related matters. They assist with visa applications, citizenship processes, and other immigration-related issues.

- U.S. Citizenship and Immigration Services (USCIS): The government agency responsible for overseeing lawful immigration to the United States. It administers various immigration benefits, such as processing visa applications, providing employment authorization, and granting lawful permanent residency or citizenship.

- Labor Markets: Refers to the collection of workers seeking employment opportunities and the demand for their services by employers. Labor market conditions can influence wage rates, job availability, and overall economic trends.

- Fair Employment Opportunities: Refers to equal and non-discriminatory access to employment opportunities for all individuals, regardless of factors such as race, gender, nationality, or religion. Fair employment opportunities aim to ensure that everyone has a fair chance to seek and obtain employment based on their skills and qualifications.

So there you have it, folks! Understanding the 2024 minimum wage increases is essential for both employees and employers. Stay informed about the changes in your state or city, adjust budgets, update payroll systems, and communicate with your workforce. And when it comes to all things immigration, travel, and visa-related, don’t forget to check out visaverge.com for more helpful information and expert advice. Happy exploring!

This Article in a Nutshell:

Understanding the minimum wage increases in 2024 is crucial for employees and employers. These increases may affect visa eligibility for foreign workers and impact business operations. Visit official state government websites or the U.S. Department of Labor for specific rates. Compliance with tipped minimum wage laws is also important, especially for industries relying on tipped employees. Stay informed, adjust budgets, update payroll systems, communicate with employees, and consult experts for a smooth transition.